Holiday Inn 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

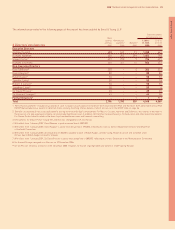

Remuneration report

Directors’ pension benefits

Increases in

transfer value

over the

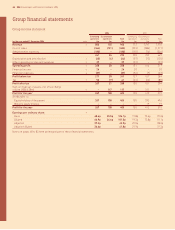

Directors’ Transfer value year, less Increase Increase Accrued

contributions of accrued benefits Directors’ in accrued in accrued pension at

Age at in the year11.1.06 31.12.06 contributions pension2pension331.12.064

Directors 31.12.06 £ £ ££ £ pa £ pa £ pa

Andrew Cosslett 51 28,300 266,900 595,300 300,100 24,200 23,600 43,800

Richard Hartman 60 1,300 1,848,200 1,935,400 85,900 8,100 5,600 94,700

Richard Solomons 45 19,500 1,227,100 1,470,500 223,900 24,500 21,000 143,800

1 Contributions paid in the year by the Directors under the terms of the plans. Contributions increased in April 2006 under the new pensions regime, to 5%

of full pensionable salary.

2 The absolute increase in accrued pension during the year.

3 The increase in accrued pension during the year excluding any increase for inflation, on the basis that increases to accrued pensions are applied at 1 October.

4 Accrued pension is that which would be paid annually on retirement at 60, based on service to 31 December 2006, except that for Richard Hartman the figure

shown is the pension at age 60, increased to allow for its late payment.

The figures shown in the above table relate to the final salary plans only. For defined contribution plans, the contributions made by and

in respect of Stevan Porter during the year are:

Director’s contribution to Company contribution to

DCP 401(k) DCP 401(k)

££ ££

Stevan Porter 43,300 6,000 Stevan Porter 80,900 4,900

The Company contributions made in respect of Richard Hartman to the IS&RP during the year are £183,100. He made no contributions.

By order of the Board

Richard Winter

Company Secretary

19 February 2007

IHG The Board, senior management and their responsibilities 39

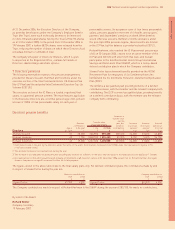

At 31 December 2006, the Executive Directors of the Company,

as potential beneficiaries under the Company’s Employee Benefit

Trust (the Trust), were each technically deemed to be interested

in 1,324,110 unallocated shares held by the Trust (2,924,775 shares

as at 31 December 2005). In the period from 31 December 2006 to

19 February 2007, a further 58,704 shares were released from the

Trust, reducing the number of shares in which these Directors hold

a residual interest to 1,265,406 in total.

The Company’s Register of Directors’ Interests, which is open

to inspection at the Registered Office, contains full details of

Directors’ shareholdings and share options.

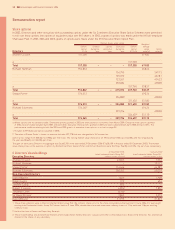

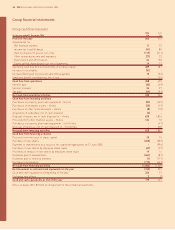

7 Directors’ pensions

The following information relates to the pension arrangements

provided for Messrs Cosslett, Hartman and Solomons under the

executive section of the InterContinental Hotels UK Pension Plan

(the IC Plan) and the unfunded InterContinental Executive Top-Up

Scheme (ICETUS).

The executive section of the IC Plan is a funded, registered, final

salary, occupational pension scheme. The main features applicable

to the Executive Directors are: a normal pension age of 60; pension

accrual of 1⁄30th of final pensionable salary for each year of

pensionable service; life assurance cover of four times pensionable

salary; pensions payable in the event of ill health; and spouses’,

partners’ and dependants’ pensions on death. When benefits

would otherwise exceed a member’s lifetime allowance under

the post-April 2006 pensions regime, these benefits are limited

in the IC Plan, but the balance is provided instead by ICETUS.

Richard Hartman, who reached the IC Plan normal pension age

of 60 on 30 January 2006, ceased to be an active member of the

IC Plan and ICETUS with effect from that date, and instead

participates in the InterContinental Hotels Group International

Savings and Retirement Plan (IS&RP), which is a Jersey-based

defined contribution plan to which the Company contributes.

Stevan Porter has retirement benefits provided via the 401(k)

Retirement Plan for employees of Six Continents Hotels Inc.

(401(k)) and the Six Continents Hotels Inc. Deferred Compensation

Plan (DCP).

The 401(k) is a tax qualified plan providing benefits on a defined

contribution basis, with the member and the relevant company both

contributing. The DCP is a non-tax qualified plan, providing benefits

on a defined contribution basis, with the member and the relevant

company both contributing.