Holiday Inn 2006 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration report

38 IHG Annual report and financial statements 2006

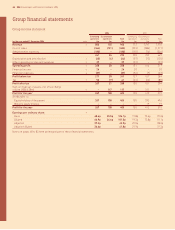

Share options

In 2003, Directors and other executives with outstanding options under the Six Continents Executive Share Option Schemes were permitted

to roll over those options into options of equivalent value over IHG shares. In 2003, a grant of options was made under the IHG all-employee

Sharesave Plan. In 2003, 2004 and 2005, grants of options were made under the IHG Executive Share Option Plan.

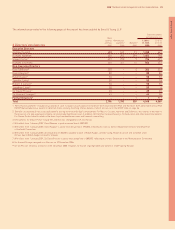

Ordinary shares under option Weighted

Options Granted Lapsed Exercised Options average

held at during the during the during the held at option Option

Directors 1.1.06 year year year 31.12.06 price (p) price (p)

Andrew Cosslett 157,300 619.83

a157,300

Total 157,300–––157,300 619.83

Richard Hartman 952,832 458.66

136,795 349.13

105,332 422.81

122,261 434.22

250,684 438.00

a337,760 538.37

Total 952,832 – – 615,072 337,760 538.37

Stevan Porter 576,513 490.34

254,8832438.00

a321,630 531.82

Total 576,513 – – 254,883 321,630 531.82

Richard Solomons 574,3651494.24

239,726 438.00

a334,6391531.10

Total 574,365 – – 239,726 334,639 531.10

a Where options are not yet exercisable. Sharesave options granted in 2003 are exercisable for six months from March 2009. Executive share options granted

in 2004 are exercisable between April 2007 and April 2014. Executive share options granted in 2005 are exercisable between April 2008 and April 2015. The

performance condition relating to both the 2004 and 2005 grants of executive share options is set out on page 33.

1 Includes 3,769 Sharesave options granted in 2003.

2 The value of Stevan Porter’s shares on exercise includes £91,778 that was chargeable to UK income tax.

Option prices range from 308.48p to 619.83p per IHG share. The closing market value share price on 29 December 2006 was 1262.00p and the range during

the year was 806.69p to 1265.00p per share.

The gain on exercise by Directors in aggregate was £6,662,750 in the year ended 31 December 2006 (£1,658,109 in the year ended 31 December 2005). The market

value share prices on the exercise of options by Richard Hartman, Stevan Porter and Richard Solomons were 1047.34p, 946.35p and 1054.12p per share respectively.

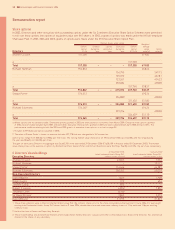

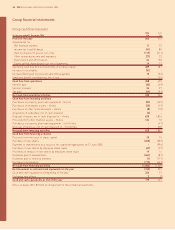

31 December 2006 1 January 20061

6 Directors’ shareholdings InterContinental Hotels Group PLC InterContinental Hotels Group PLC

Executive Directors ordinary shares of 113⁄7p3ordinary shares of 10p

Andrew Cosslett 42,063 7,332

Richard Hartman – 70,117

Stevan Porter 114,446 64,589

Richard Solomons 104,247 60,339

Non-Executive Directors

David Kappler 1,669 1,908

Ralph Kugler 572 654

Jennifer Laing 875 –

Robert C Larson 6,87427,8572

Jonathan Linen 8,7502–

Sir David Prosser 2,863 3,273

David Webster 31,975 31,823

1 These share interests were in InterContinental Hotels Group PLC 10p ordinary shares prior to the share consolidation effective from 12 June 2006. For every eight

existing InterContinental Hotels Group PLC shares held on 9 June 2006, shareholders received seven new ordinary shares of 113⁄7p each and 118p per existing

ordinary share.

2 Held in the form of American Depositary Receipts.

3 These shareholdings are all beneficial interests and include shares held by Directors’ spouses and other connected persons. None of the Directors has a beneficial

interest in the shares of any subsidiary.