Holiday Inn 2006 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration report

IHG The Board, senior management and their responsibilities 35

The information provided in the following pages of this report has been audited by Ernst & Young LLP.

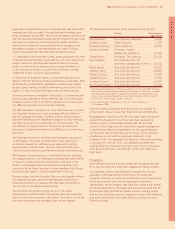

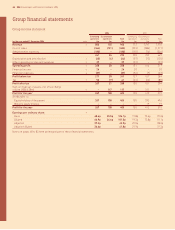

Total emoluments

Base excluding pensions

salaries Performance 1.1.06 to 1.1.05 to

and fees payments1Benefits231.12.06 31.12.05

4 Directors’ emoluments £000 £000 £000 £000 £000

Executive Directors

Andrew Cosslett 688 549 31 1,268 663

Richard Hartman 503 203 299 1,005 798

Stevan Porter3427 290 9 726 429

Richard Solomons 440 351 15 806 423

Non-Executive Directors

David Webster4350 – 4 354 522

David Kappler580 – – 80 80

Ralph Kugler650 – – 50 50

Jennifer Laing650 – – 50 18

Robert C Larson650 – – 50 50

Jonathan Linen650 – – 50 4

Sir David Prosser765 – – 65 65

Sir Howard Stringer843 – – 43 50

Former Directors9––11917

Total 2,796 1,393 359 4,548 4,069

1 ‘Performance payments’ include bonus awards in cash in respect of participation in the Short Term Incentive (STI) Plan and the Short Term Deferred Incentive Plan

(STDIP) but exclude bonus awards in deferred shares and any matching shares, details of which are set out in the STDIP table on page 36.

2 ‘Benefits’ incorporate all tax assessable benefits arising from the individual’s employment. For Messrs Cosslett, Hartman and Solomons, this relates in the main to

the provision of a fully expensed company car and private healthcare cover. In addition, Mr Hartman received housing, child education and other expatriate benefits.

For Stevan Porter, benefits relate in the main to private healthcare cover and financial counselling.

3 Emoluments for Stevan Porter include £51,413 that was chargeable to UK income tax.

4 With effect from 1 January 2007, David Webster is paid an annual fee of £390,000.

5 With effect from 1 January 2007, David Kappler is paid a total annual fee of £95,000, reflecting his roles as Senior Independent Director and Chairman

of the Audit Committee.

6 With effect from 1 January 2007, an annual fee of £60,000 is payable to each of Ralph Kugler, Jennifer Laing, Robert C Larson and Jonathan Linen.

All fees due to Ralph Kugler are paid to Unilever.

7 With effect from 1 January 2007, Sir David Prosser is paid a total annual fee of £80,000, reflecting his role as Chairman of the Remuneration Committee.

8 Sir Howard Stringer resigned as a Director on 10 November 2006.

9 Sir Ian Prosser retired as a Director on 31 December 2003. However, he had an ongoing healthcare benefit of £1,027 during the year.