Holiday Inn 2006 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements

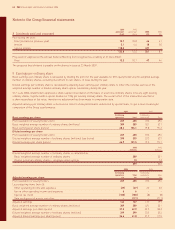

2006 2005

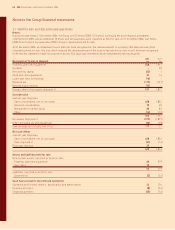

5 Special items note £m £m

Other operating income and expenses*

Gain on sale of investment a25 –

Reversal of previously recorded impairment b2–

Impairment of property, plant and equipment c–(7)

Restructuring costs d–(13)

Property damage e–(9)

Employee benefits curtailment gain f–7

27 (22)

Tax*

Tax charge on other operating income and expenses (6) –

Special tax credit g100 8

94 8

Gain on disposal of assets

Gain on disposal of assets 123 349

Tax charge (6) (38)

117 311

* Relates to continuing operations.

The above items are treated as special by reason of their size or incidence (note 9).

a Gain on the sale of the Group’s investment in FelCor Lodging Trust, Inc.

b Relates to the reversal of impairment in value of an associate investment.

c Property, plant and equipment were written down by £7m in 2005 following an impairment review of the hotel estate.

d Restructuring costs relate to the delivery of the further restructuring of the Hotels business.

e Damage to properties resulting from fire and natural disasters.

f Curtailment gain arising as a result of the sale of UK hotel properties.

g Represents the release of provisions which are special by reason of their size or incidence relating to tax matters which have been settled or in respect of which

the relevant statutory limitation period has expired, together with, in 2006, a credit in respect of previously unrecognised losses.

2006 2005

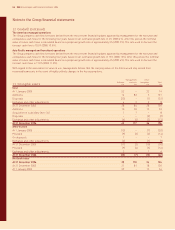

6 Finance costs £m £m

Financial income

Interest income 21 28

Fair value gains 52

26 30

Financial expenses

Interest expense – Hotels 33 51

Interest expense – Soft Drinks –9

Finance charge payable under finance leases 4–

37 60

Fair value charge –3

37 63

Included within the Hotels interest expense is £10m (2005 £5m) payable to the Group’s loyalty programme relating to interest paid on the

accumulated balance of cash received in advance of the redemption of points awarded.

60 IHG Annual report and financial statements 2006