Holiday Inn 2006 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

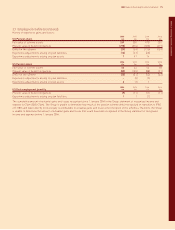

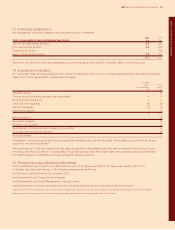

33 Related party disclosures

Key management personnel comprises the Board and Executive Committee.

2006 2005

Total compensation of key management personnel £m £m

Short-term employment benefits 9.5 6.5

Post-employment benefits 0.5 0.2

Termination benefits –0.8

Equity compensation benefits 7.9 6.9

17.9 14.4

There were no transactions with key management personnel during the year ended 31 December 2006 or the previous year.

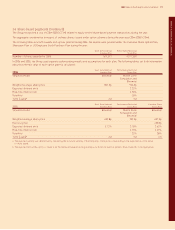

34 Acquisition of subsidiary

On 1 December 2006, the Group acquired a 75% interest in ANA Hotels & Resorts Co., Ltd (subsequently renamed IHG ANA Hotels Group

Japan LLC), a hotel management company based in Japan.

Carrying

values Fair

pre-acquisition value

£m £m

Intangible assets 18

Current assets (excluding cash and cash equivalents) 4 4

Cash and cash equivalents 44

Trade and other payables (3) (3)

Current tax payable (1) (1)

Deferred tax payable – (1)

511

Minority interest (3)

Net assets acquired 8

Goodwill on acquisition 2

Consideration, satisfied in cash (including costs of £2m) 10

Cash and cash equivalents acquired (4)

Net cash outflow 6

Management contracts acquired have been recognised as intangible assets at their fair value. The residual excess over the net assets

acquired is recognised as goodwill.

The operating profit of the joint venture from the date of acquisition to the balance sheet date was not material to the Group’s results.

If the acquisition had occurred on 1 January 2006, Group revenue would have been £16m higher and operating profit would have been

£2m higher, based on local GAAP and the pre-acquisition business structure.

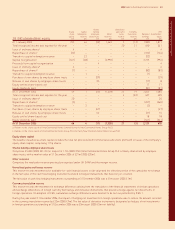

35 Principal operating subsidiary undertakings

InterContinental Hotels Group PLC was the beneficial owner of all (unless specified) of the equity share capital, either itself

or through subsidiary undertakings, of the following companies during the year:

Six Continents Limited (formerly Six Continents PLC)

InterContinental Hotels Group Services Company

InterContinental Hotels Group (Management Services) Limited

InterContinental Hotels Group Operating Corporation (incorporated and operates principally in the United States)

Unless stated otherwise, companies are incorporated in Great Britain, registered in England and Wales and operate principally within the United Kingdom.

The companies listed above include all those which principally affect the amount of profit and assets of the Group.

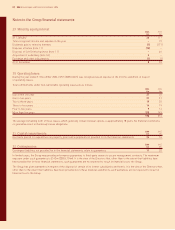

IHG Notes to the Group financial statements 83

Notes to the Group financial statements