Holiday Inn 2006 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IHG Operating and financial review 13

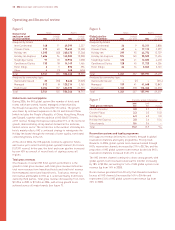

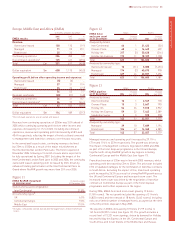

Figure 12

EMEA hotel Hotels Rooms

and room count Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 66 121,423 (50)

Crowne Plaza 68 416,440 409

Holiday Inn 317 (3) 50,628 (316)

Holiday Inn Express 172 11 18,109 1,138

Total 623 13 106,600 1,181

Analysed by ownership type:

Owned and leased 10 (31) 3,088 (7,453)

Managed 174 (2) 40,675 978

Franchised 439 46 62,837 7,656

Total 623 13 106,600 1,181

Figure 13

Hotels Rooms

EMEA pipeline Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 10 12,549 170

Crowne Plaza 15 33,667 790

Holiday Inn 54 26 7,818 2,952

Holiday Inn Express 59 22 7,445 3,289

Staybridge Suites 55578 578

Total 143 57 22,057 7,779

Analysed by ownership type:

Managed 39 10 7,689 1,194

Franchised 104 47 14,368 6,585

Total 143 57 22,057 7,779

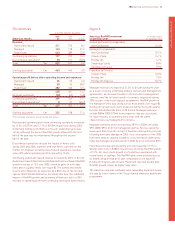

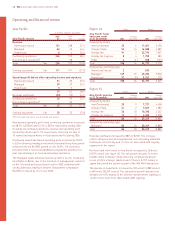

Managed revenues and operating profit increased by 29.1% to

£71m and 19.4% to £37m respectively. The growth was driven by

the impact of management contracts negotiated in 2005 and 2006

as part of the hotel disposal programme in the UK and Europe,

together with strong RevPAR growth in key regions including

Continental Europe and the Middle East (see figure 11).

Franchised revenue of £35m was in line with 2005 revenues, whilst

operating profit decreased by £2m to £24m. The prior year included

£7m in liquidated damages for the termination of franchise contracts

in South Africa. Excluding the impact of this, franchised operating

profit increased by 26.3% as a result of strong RevPAR growth across

the UK and Continental Europe and increased room count. The

increased room count was driven by the negotiation of franchise

contracts in Continental Europe as part of the hotel disposal

programme and further expansion in the region.

During 2006, EMEA hotel and room count grew by 13 hotels

(1,181 rooms). The net growth included the opening of 31 hotels

(4,823 rooms) and the removal of 18 hotels (3,642 rooms), including

exits on a limited number of managed hotels, as agreed at the time

of the UK portfolio disposal in May 2005.

The pipeline in EMEA increased by 57 hotels (7,779 rooms) to

143 hotels (22,057 rooms) (see figure 13). The growth includes a

record level of 13,321 room signings, driven by demand for Holiday

Inn and Holiday Inn Express in the UK, Continental Europe and

South Africa, and for all brands in the Middle East and Russia.

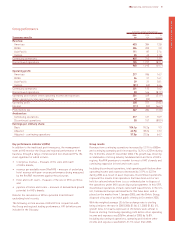

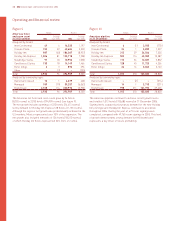

Operating and financial review

Europe, Middle East and Africa (EMEA)

12 months ended 31 December

2006 2005 %

EMEA results £m £m change

Revenue:

Owned and leased 100 110 (9.1)

Managed 71 55 29.1

Franchised 35 35 –

Continuing operations 206 200 3.0

Discontinued operations* 125 411 (69.6)

Total £m 331 611 (45.8)

Dollar equivalent $m 608 1,115 (45.5)

Operating profit before other operating income and expenses:

Owned and leased (5) (5) –

Managed 37 31 19.4

Franchised 24 26 (7.7)

56 52 7.7

Regional overheads (20) (21) (4.8)

Continuing operations 36 31 16.1

Discontinued operations* 26 73 (64.4)

Total £m 62 104 (40.4)

Dollar equivalent $m 114 189 (39.7)

*Discontinued operations are all owned and leased.

Revenue from continuing operations of £206m was 3.0% ahead of

2005 whilst continuing operating profit before other income and

expenses increased by 16.1% to £36m. Including discontinued

operations, revenue and operating profit decreased by 45.8% and

40.4% respectively, reflecting the impact of hotels sold and converted

to management and franchise contracts over the past two years.

In the owned and leased estate, continuing revenues declined

by £10m to £100m as a result of the major refurbishment at

the InterContinental London Park Lane. The hotel reopened in

November 2006 following a 13 month closure and is expected to

be fully operational by Spring 2007. Excluding the impact of the

InterContinental London Park Lane in 2005 and 2006, the continuing

owned and leased operating profit increased by £5m, driven by

enhanced trading performance at the InterContinental Paris Le

Grand where RevPAR growth was more than 25% over 2005.

Figure 11

EMEA RevPAR movement 12 months ended

on previous year 31 December 2006

Owned and leased (comparable):

InterContinental 21.8%

All ownership types*:

UK 6.0%

Continental Europe 9.0%

Middle East 19.0%

*Includes comparable owned, leased and managed hotels and all franchised

hotels.