Holiday Inn 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

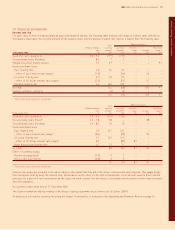

Notes to the Group financial statements

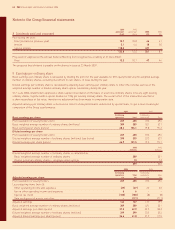

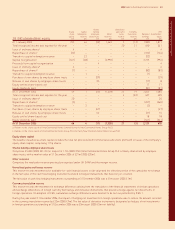

22 Financial instruments (continued)

Fair values

The table below compares carrying amounts and fair values of the Group’s financial instruments.

2006 2005

Carrying Carrying

value Fair value value Fair value

note £m £m £m £m

Financial assets

Cash and cash equivalents 18 179 179 324 324

Equity securities available-for-sale 15 57 57 145 145

Derivatives 15 4422

Other financial assets 15 48 48 72 72

Financial liabilities

Borrowings, excluding finance lease liabilities 20 (216) (216) (412) (412)

Liabilities under finance leases 20 (97) (97) ––

Derivatives 19 ––(6) (6)

The fair value of cash and cash equivalents approximates book value due to the short maturity of the investments and deposits. Equity

securities available-for-sale and derivatives are held on the balance sheet at fair value as set out in note 15. The fair value of other

financial assets approximates book value based on prevailing market rates. The fair value of borrowings, excluding finance lease liabilities,

approximates book value as interest rates reset to market rates on a frequent basis. The fair value of the finance lease liability is deemed

to be its book value as the inception of the lease was shortly before 31 December 2006.

Trade and other receivables and trade and other payables are not included in the above tables as their carrying value approximates to their

fair value, including the future redemption liability of the Group’s loyalty programme.

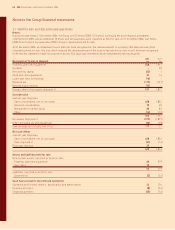

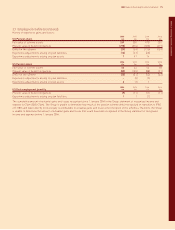

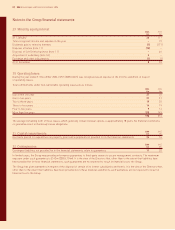

23 Employee benefits

Retirement and death in service benefits are provided for eligible Group employees in the UK principally by the InterContinental Hotels

UK Pension Plan. The plan covers approximately 410 (2005 400) employees, of which 220 (2005 240) are in the defined benefit section which

provides pensions based on final salaries and 190 (2005 160) are in the defined contribution section. The assets of the plan are held in self-

administered trust funds separate from the Group’s assets. The Group also maintains a US-based InterContinental Hotels Pension Plan

and post-employment benefits scheme. This plan is now closed to new members and pensionable service no longer accrues for current

employee members. In addition, the Group operates a number of minor pension schemes outside the UK, the most significant of which is

a defined contribution scheme in the US; there is no material difference between the pension costs of, and contributions to, those schemes.

On 14 December 2005, the Soft Drinks business, including the Britvic Pension Plan, was sold. The comparative information provided below

includes movements for the Britvic Pension Plan up to the date of disposal.

The amounts recognised in the income statement are:

Pension plans Post-employment

UK US benefits Total

2006 2005 2006 2005 2006 2005 2006 2005

Recognised in administrative expenses £m £m £m £m £m £m £m £m

Current service cost 519 ––––519

Interest cost on benefit obligation 13 30 561119 37

Expected return on plan assets (14) (32) (4) (5) ––(18) (37)

417 1111619

Recognised in other operating income and expense

Plan curtailment –(7) –––––(7)

The curtailment gain arose as a result of the sale of 73 UK hotel properties.

72 IHG Annual report and financial statements 2006