Holiday Inn 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

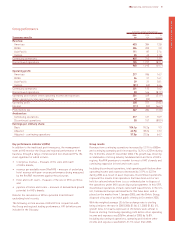

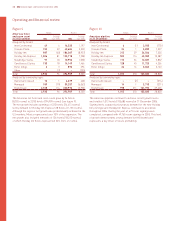

Figure 9

Americas hotel Hotels Rooms

and room count Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 49 416,525 1,197

Crowne Plaza 155 22 42,604 5,530

Holiday Inn 987 (40) 186,067 (8,937)

Holiday Inn Express 1,506 81 123,718 7,908

Staybridge Suites 97 10 10,953 1,038

Candlewood Suites 130 18 14,149 1,466

Hotel Indigo 63893 396

Other –(2) –(295)

Total 2,930 96 394,909 8,303

Analysed by ownership type:

Owned and leased 13 14,679 428

Managed 189 (19) 39,257 (6,063)

Franchised 2,728 114 350,973 13,938

Total 2,930 96 394,909 8,303

The Americas net hotel and room count grew by 96 hotels

(8,303 rooms) to 2,930 hotels (394,909 rooms) (see figure 9).

The net growth includes openings of 222 hotels (26,613 rooms)

led by demand for Holiday Inn Express 128 hotels (11,155 rooms).

Although the regions’ net growth was predominantly achieved in the

US markets, Mexico represented over 10% of the expansion. The

net growth also included removals of 126 hotels (18,310 rooms),

of which Holiday Inn hotels represented 56% (74% of rooms).

Operating and financial review

12 IHG Annual report and financial statements 2006

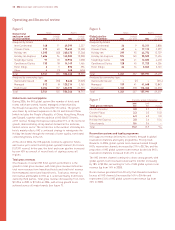

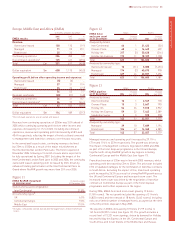

Figure 10

Hotels Rooms

Americas pipeline Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 6(1) 2,935 (770)

Crowne Plaza 24 15,839 1,227

Holiday Inn 212 59 26,566 7,525

Holiday Inn Express 503 114 43,550 10,587

Staybridge Suites 115 36 12,027 3,832

Candlewood Suites 128 45 11,723 4,256

Hotel Indigo 24 16 3,045 2,163

Total 1,012 270 105,685 28,820

Analysed by ownership type:

Owned and leased –(2) –(574)

Managed 14 13,710 (231)

Franchised 998 271 101,975 29,625

Total 1,012 270 105,685 28,820

The Americas pipeline continued to achieve record growth levels

and totalled 1,012 hotels (105,685 rooms) at 31 December 2006.

Signing levels outpaced prior year as demand for the new Holiday

Inn prototype and Holiday Inn Express continued to accelerate

throughout 2006. During the year 61,673 room signings were

completed, compared with 49,765 room signings in 2005. This level

of growth demonstrates strong demand for IHG brands and

represents a key driver of future profitability.