Holiday Inn 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements

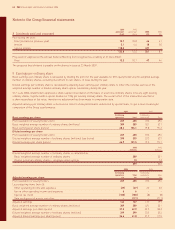

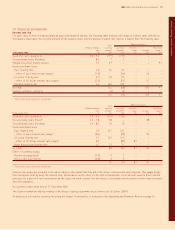

14 Investments in associates

The Group holds six investments (2005 eight) accounted for as associates. The following table summarises the financial information

of the associates.

2006 2005

£m £m

Share of associates’ balance sheet

Current assets 24

Non-current assets 50 93

Current liabilities (5) (9)

Non-current liabilities (15) (46)

Net assets 32 42

Share of associates’ revenue and profit

Revenue 22 18

Net profit 21

Related party transactions

Revenue from related parties 43

Amounts owed by related parties 12

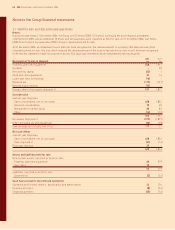

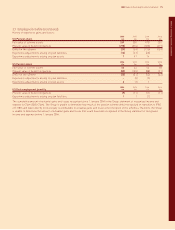

2006 2005

15 Other financial assets £m £m

Non-current

Equity securities available-for-sale 48 41

Other 48 72

96 113

Current

Equity securities available-for-sale 9104

Derivatives 42

13 106

Available-for-sale financial assets, which are held on the balance sheet at fair value, consist of equity investments in listed and unlisted

shares. The fair value of unlisted equity shares has been estimated using valuation guidelines issued by the British Venture Capital Association

and is based on assumptions regarding expected future earnings. Listed equity share valuation is based on observable market prices.

Other financial assets consist mainly of trade deposits made in the normal course of business. The deposits have been designated as

loans and receivables and are held at amortised cost.

Derivatives, including those within trade and other payables, are held on the balance sheet at fair value. The fair value is the estimated

amount that the Group could expect to receive on the termination of the agreement, taking into consideration interest and exchange rates

prevailing at the balance sheet date.

IHG Notes to the Group financial statements 67