Holiday Inn 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

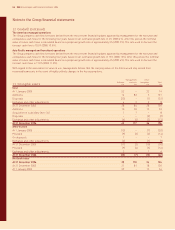

Notes to the Group financial statements

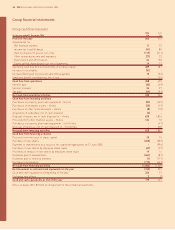

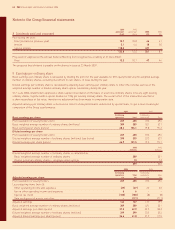

2 Segmental information (continued)

Year ended 31 December 2006

Americas EMEA Asia Pacific Central Total Group

Assets and liabilities £m £m £m £m £m

Segment assets 647 583 338 73 1,641

Non-current assets classified as held for sale 40 10 – – 50

687 593 338 73 1,691

Unallocated assets:

Current tax receivable 23

Cash and cash equivalents 179

Total assets 1,893

Segment liabilities 295 234 53 – 582

Liabilities classified as held for sale 2–––2

297 234 53 – 584

Unallocated liabilities:

Current tax payable 231

Deferred tax payable 79

Loans and other borrowings 313

Total liabilities 1,207

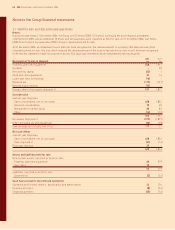

Americas EMEA Asia Pacific Central Total Group

Other segmental information £m £m £m £m £m

Continuing operations:

Capital expenditurea34 50 17 15 116

Additions to:

Property, plant and equipment 116 53 9 4 182

Intangible assets 10 31 1 11 53

Depreciation and amortisationb18 19 10 13 60

Reversal of previously recorded impairment – (2) – – (2)

Discontinued operations:

Capital expenditurea17––8

Additions to property, plant and equipment –4––4

Depreciation and amortisationb13––4

Impairment of assets held for sale 3–––3

a Comprises purchases of property, plant and equipment, intangible assets and other financial assets and acquisitions of subsidiaries as included in the Group cash

flow statement.

b Included in the £64m of depreciation and amortisation is £21m relating to administrative expenses and £43m relating to cost of sales.

56 IHG Annual report and financial statements 2006