Holiday Inn 2006 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

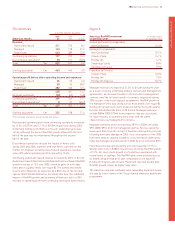

Operating and financial review

10 IHG Annual report and financial statements 2006

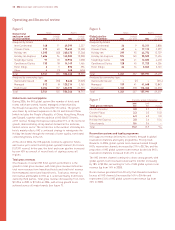

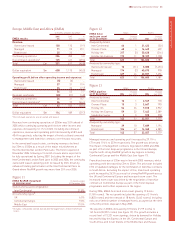

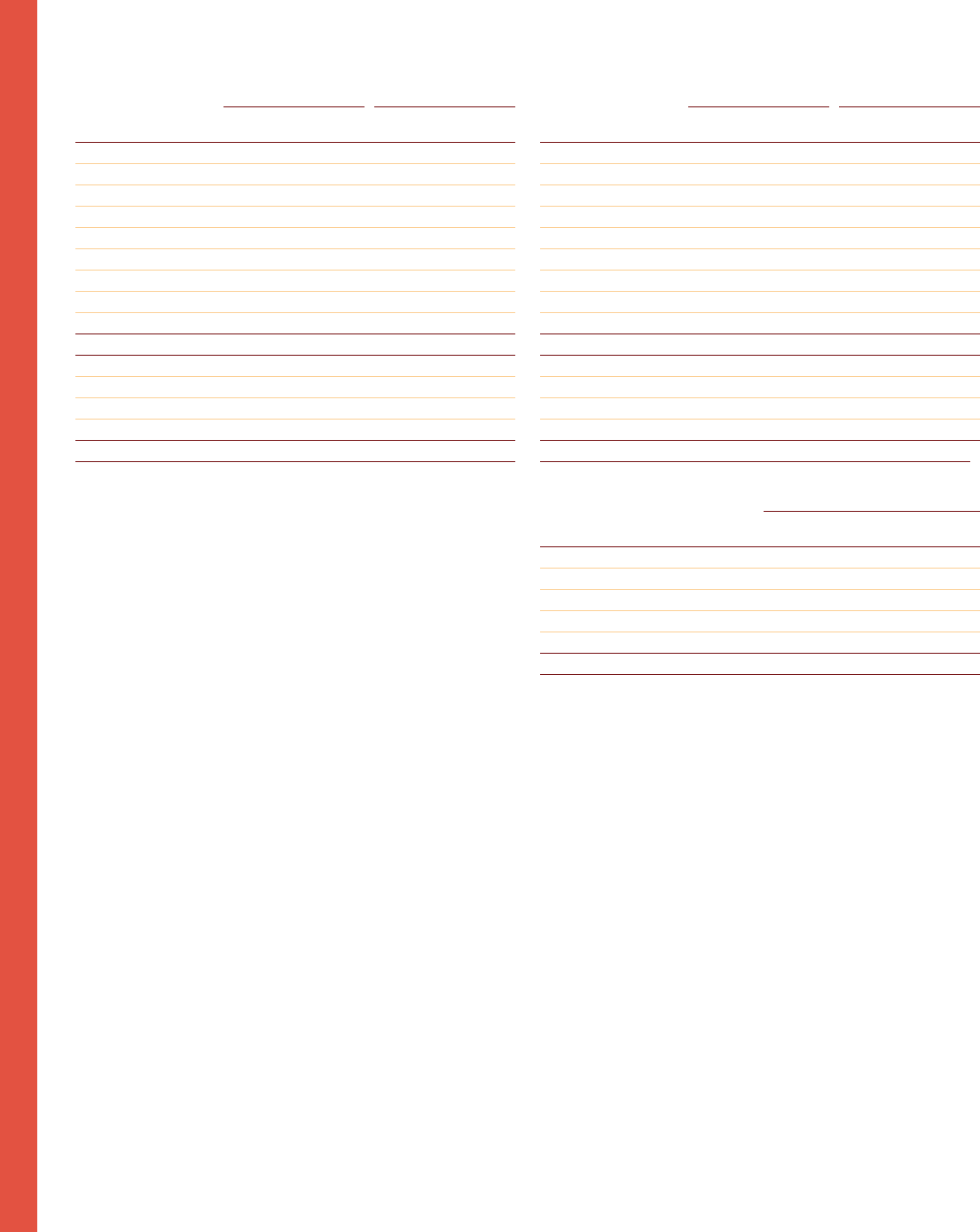

Figure 6

Hotels Rooms

Global pipeline Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 36 913,211 3,858

Crowne Plaza 60 617,113 3,599

Holiday Inn 299 95 44,774 13,739

Holiday Inn Express 574 145 55,520 17,454

Staybridge Suites 120 41 12,605 4,410

Candlewood Suites 128 45 11,723 4,256

Hotel Indigo 24 16 3,045 2,163

Total 1,241 357 157,991 49,479

Analysed by ownership type:

Owned and leased –(2) –(574)

Managed 139 41 41,648 13,843

Franchised 1,102 318 116,343 36,210

Total 1,241 357 157,991 49,479

Figure 7 12 months ended 31 December

2006 2005 %

Total gross revenues $bn $bn change

InterContinental 3.0 2.7 11.1

Crowne Plaza 2.3 2.0 15.0

Holiday Inn 6.3 6.0 5.0

Holiday Inn Express 3.0 2.6 15.4

Other brands 0.6 0.6 –

Total 15.2 13.9 9.4

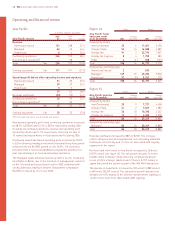

Reservation systems and loyalty programme

IHG supports revenue delivery into its hotels through its global

reservation channels and loyalty programme, Priority Club

Rewards. In 2006, global system room revenue booked through

IHG’s reservation channels increased by 21% to $5.7bn, and the

proportion of IHG global system room revenue booked via IHG’s

reservation channels increased from 41% to 44%.

The IHG internet channel continued to show strong growth, with

global system room revenue booked via the internet increasing

by 18% to $2.0bn, accounting for 16% of IHG global system room

revenue (up from 14% in 2005).

Room revenue generated from Priority Club Rewards members

(across all IHG channels) increased by 16% to $4.4bn and

represented 34% of IHG global system room revenue (up from

32% in 2005).

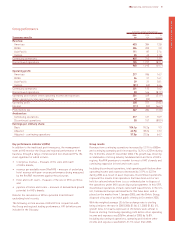

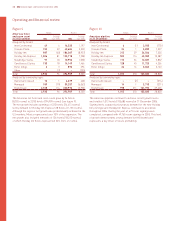

Figure 5

Global hotel Hotels Rooms

and room count Change Change

at 31 December 2006 over 2005 2006 over 2005

Analysed by brand:

InterContinental 148 11 49,599 3,337

Crowne Plaza 275 40 75,632 10,228

Holiday Inn 1,395 (40) 260,470 (7,346)

Holiday Inn Express 1,686 96 143,582 10,028

Staybridge Suites 97 10 10,953 1,038

Candlewood Suites 130 18 14,149 1,466

Hotel Indigo 63893 396

Other 4(3) 968 (434)

Total 3,741 135 556,246 18,713

Analysed by ownership type:

Owned and leased 25 (30) 8,460 (7,025)

Managed 512 8125,214 3,965

Franchised 3,204 157 422,572 21,773

Total 3,741 135 556,246 18,713

Global room count and pipeline

During 2006, the IHG global system (the number of hotels and

rooms which are owned, leased, managed or franchised by

the Group) increased by 135 hotels (18,713 rooms). The growth

was driven by continued expansion in the US and Greater China

(which includes the People’s Republic of China, Hong Kong, Macau

and Taiwan), together with the addition of IHG ANA (13 hotels,

4,937 rooms). Holiday Inn Express represented 71% of the net hotel

growth, demonstrating strong market demand in the midscale,

limited service sector. The net decline in the number of Holiday Inn

hotels mainly reflects IHG’s continued strategy to reinvigorate the

Holiday Inn brand through the removal of lower quality, non-brand

conforming hotels in the US.

At the end of 2006, the IHG pipeline (contracts signed for hotels

and rooms yet to enter the IHG global system) totalled 1,241 hotels

(157,991 rooms). In the year, the hotel and room pipeline increased

by over 40% as a result of record levels of signings across all

regions.

Total gross revenues

One measure of overall IHG hotel system performance is the

growth in total gross revenue, with total gross revenue defined as

total room revenue from franchised hotels and total hotel revenue

from managed, owned and leased hotels. Total gross revenue is

not revenue attributable to IHG, as it is derived mainly from hotels

owned by third parties. Total gross revenue increased by 9.4% from

$13.9bn in 2005 to $15.2bn in 2006, with strong growth levels

achieved across all major brands (see figure 7).