Holiday Inn 2006 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

IHG Chairman’s statement and Chief Executive’s review 3

Chairman’s statement and Chief Executive’s review

Chief Executive’s review

2006 was a year of excellent growth for IHG. The hotel industry

as a whole grew strongly, benefiting from trends that will drive

demand for hotel rooms for many years. IHG, through its strong

brand family, powerful operating systems that drive demand to our

hotels and unmatched global position, outperformed the industry.

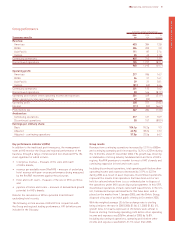

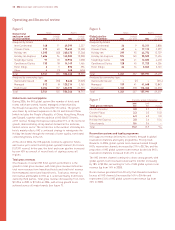

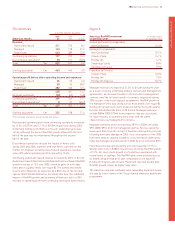

Strong trading Continuing operating profit*was up 16 per cent, from £173 million to

£201 million. Adjusted continuing earnings per share rose 67 per cent, from 22.5p to 37.5p.

Global revenue per available room (RevPAR) – the industry’s main performance measure

– rose by 9.8 per cent, mainly driven by rate increases. Our RevPAR growth outperformed

the market in each of our seven key profit generating business areas around the world.

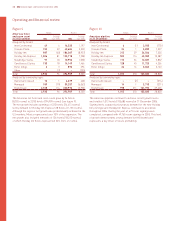

Increased rooms growth We made good progress against the three year target we set

in 2005 of adding 50,000 to 60,000 net rooms, reaching 125 hotels in China, and adding

15 to 25 InterContinentals by the end of 2008. We expected to add in the region of 10,000

net rooms in 2006, and in fact added 18,713. This included 4,937 rooms from IHG’s joint

venture in Japan with All Nippon Airlines. This deal makes us the largest international

hotel operator in Japan, the world’s second largest hotel market, and we will be building

on this position over the coming years. We further strengthened our market leading

position in China. InterContinental expanded rapidly with 15 hotels opened in the year.

Overall, during 2006 we signed deals for nearly 103,000 hotel rooms, a 47 per cent

increase on 2005. Our pipeline of rooms, already the largest in the industry, increased

46 per cent in the year and now stands at almost 158,000 rooms.

Given this strong level of openings and signings, we now expect to exceed our net

rooms growth target by the end of 2008.

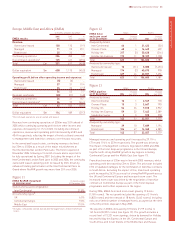

Strengthening our business We have been developing plans to help us be better at what

we do. During the year we undertook what we believe to be the biggest market research

project involving hotels. We have looked inside and outside the industry for examples of

best practice in franchising so that we can take what is already one of IHG’s existing

strengths to a new level. We now have a deeper insight into how our hotel brands can be

improved so that they address our guests’ needs more effectively. The excellent brand

performance in 2006 is very encouraging and suggests that we are on the right track.

These insights and learnings are proving effective in helping us to achieve IHG’s business

objectives and position us well for stronger performance in the years to come.

In the pages that follow we review the operational and financial performance of the

Group and our different regions and demonstrate how we are gearing up for growth.

Growth is our goal and we are increasingly well placed to achieve it. We have a clear

strategy, strong position and good people. Not surprisingly, our outlook remains positive.

Andrew Cosslett Chief Executive

*Operating profit before other operating income and expenses.