Holiday Inn 2006 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2006 Holiday Inn annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Group financial statements

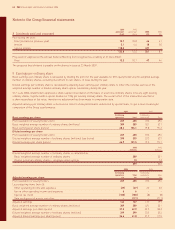

12 Goodwill (continued)

The Americas managed operations

The Group prepares cash flow forecasts derived from the most recent financial budgets approved by management for the next year and

extrapolates cash flows for the following four years based on an estimated growth rate of 4% (2005 4%). After this period, the terminal

value of future cash flows is calculated based on a perpetual growth rate of approximately 3% (2005 3%). The rate used to discount the

forecast cash flow is 10.5% (2005 10.5%).

Asia Pacific managed and franchised operations

The Group prepares cash flow forecasts derived from the most recent financial budgets approved by management for the next year and

extrapolates cash flows for the following four years based on an estimated growth rate of 15% (2005 15%). After this period, the terminal

value of future cash flows is calculated based on a perpetual growth rate of approximately 4% (2005 4%). The rate used to discount the

forecast cash flows is 11.0% (2005 11.0%).

With regard to the assessment of value in use, management believe that the carrying values of the CGUs would only exceed their

recoverable amounts in the event of highly unlikely changes in the key assumptions.

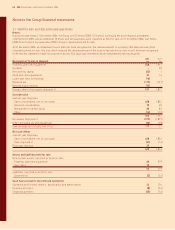

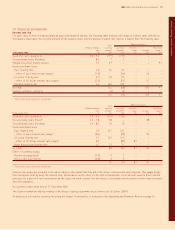

Management Other

Software contracts intangibles Total

13 Intangible assets £m £m £m £m

Cost

At 1 January 2005 52 – 22 74

Additions 14 82 5 101

Disposals (32) – (1) (33)

Exchange and other adjustments 4228

At 31 December 2005 38 84 28 150

Additions 10 30 13 53

Acquisition of subsidiary (note 34) 17–8

Disposals – – (2) (2)

Exchange and other adjustments (6) (4) (3) (13)

At 31 December 2006 43 117 36 196

Amortisation

At 1 January 2005 (13) – (7) (20)

Provided (9) (3) (2) (14)

On disposals 7––7

Exchange and other adjustments (2) – (1) (3)

At 31 December 2005 (17) (3) (10) (30)

Provided (9) (4) (3) (16)

Exchange and other adjustments 3–14

At 31 December 2006 (23) (7) (12) (42)

Net book value

At 31 December 2006 20 110 24 154

At 31 December 2005 21 81 18 120

At 1 January 2005 39 – 15 54

66 IHG Annual report and financial statements 2006