Harley Davidson 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

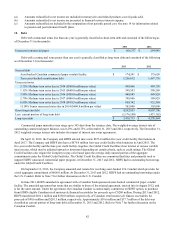

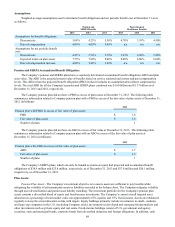

equivalent balances are maintained at levels adequate to meet near-term plan expenses and benefit payments. Investment risk is

measured and monitored on an ongoing basis through quarterly investment portfolio reviews.

Postretirement Healthcare Plan Assets - The Company's investment objective is to maximize the return on assets to help

pay the benefits by prudently investing in equities, fixed income and alternative assets. The Company's current overall targeted

asset allocation as a percentage of total market value was approximately 70% equities and 30% fixed-income. Equity holdings

primarily include investments in small-, medium-, and large-cap companies in the U.S., investments in developed and emerging

foreign markets and alternative investments such as private equity and real estate. Fixed-income holdings consist of U.S.

government and agency securities, state and municipal bonds, corporate bonds from diversified industries and foreign

obligations. In addition, cash equivalent balances are maintained at levels adequate to meet near-term plan expenses and benefit

payments. Investment risk is measured and monitored on an ongoing basis through quarterly investment portfolio reviews.

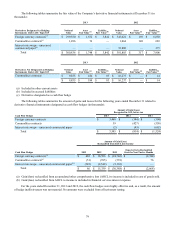

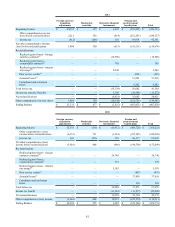

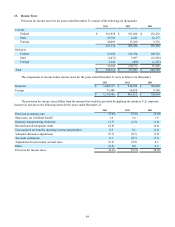

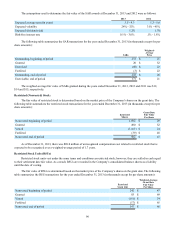

The following tables present the fair values of the plan assets related to the Company’s pension and postretirement

healthcare plans within the fair value hierarchy as defined in Note 8.

The fair values of the Company’s pension plan assets as of December 31, 2013 were as follows (in thousands):

Balance as of

December 31, 2013

Quoted Prices in

Active Markets for

Identical Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Assets:

Cash and cash equivalents $ 40,578 $ — $ 40,578 $ —

Equity holdings:

U.S. companies 519,405 516,444 2,961 —

Foreign companies 125,361 125,320 41 —

Harley-Davidson common stock 88,184 88,184 — —

Pooled equity funds 558,004 558,004 — —

Limited partnership interests 34,234 — — 34,234

Other — — — —

Total equity holdings 1,325,188 1,287,952 3,002 34,234

Fixed-income holdings:

U.S. Treasuries 34,044 34,044 — —

Federal agencies 33,250 — 33,250 —

Corporate bonds 223,992 — 223,992 —

Pooled fixed income funds 212,465 51,959 160,506 —

Foreign bonds 40,885 — 40,885 —

Municipal bonds 10,199 — 10,199 —

Total fixed-income holdings 554,835 86,003 468,832 —

Total pension plan assets $ 1,920,601 $ 1,373,955 $ 512,412 $ 34,234

Included in the pension plan assets are 1,273,592 shares of the Company’s common stock with a market value of $88.2

million at December 31, 2013.

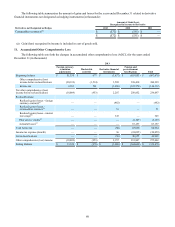

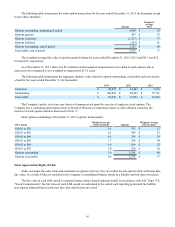

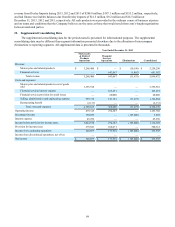

The following table presents a reconciliation of the fair value measurements using significant unobservable inputs (Level

3) as of December 31, 2013 (in thousands):

Total Limited Partnership

Interests Other

Balance, beginning of period $ 36,582 $ 35,954 $ 628

Actual return on plan assets:

Relating to assets still held at the reporting date 2,951 2,951 —

Purchases, sales and settlements (5,299)(4,671)(628)

Balance, end of period $ 34,234 $ 34,234 $ —