Harley Davidson 2013 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

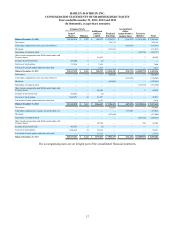

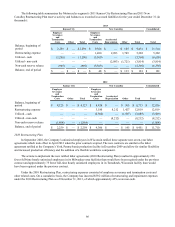

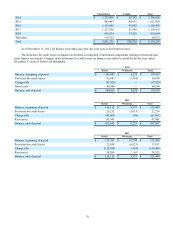

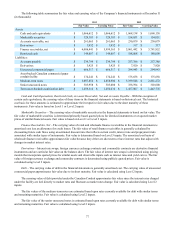

The following table summarizes the Motorcycles segment’s 2010 Restructuring Plan reserve activity and balances as

recorded in accrued liabilities for the following years ended December 31 (in thousands):

2013 2012 2011

Employee

Severance and

Termination Costs

Employee

Severance and

Termination Costs

Employee

Severance and

Termination Costs

Balance, beginning of period $ 10,156 $ 20,361 $ 8,652

Restructuring expense — 4,005 12,575

Utilized – cash (9,725)(12,898)(866)

Utilized – non-cash — — —

Non-cash reserve release (431)(1,312) —

Balance, end of period $ — $ 10,156 $ 20,361

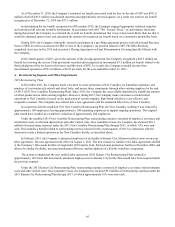

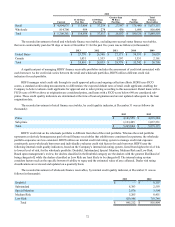

2009 Restructuring Plan

During 2009, in response to the U.S. economic recession and worldwide slowdown in consumer demand, the Company

committed to a volume reduction and a combination of restructuring actions (2009 Restructuring Plan) that were completed at

various dates between 2009 and 2013. The actions were designed to reduce administrative costs, eliminate excess capacity and

exit non-core business operations. The Company’s actions included the restructuring and transformation of its York,

Pennsylvania production facility including the implementation of a new more flexible unionized labor agreement which allows

for the addition of a flexible workforce component; consolidation of facilities related to engine and transmission production;

outsourcing of certain distribution and transportation activities and exiting the Buell product line. In addition, the Company

completed projects under this plan involving the outsourcing of select information technology activities and the consolidation

of an administrative office in Michigan into its corporate headquarters in Milwaukee, Wisconsin.

The 2009 restructuring plan resulted in a reduction of approximately 2,900 hourly production positions and

approximately 800 non-production, primarily salaried positions within the Motorcycles segment and approximately 100

salaried positions in the Financial Services segment.

Under the 2009 Restructuring Plan, restructuring expenses consisted of employee severance and termination costs,

accelerated depreciation on the long-lived assets exited as part of the 2009 Restructuring Plan and other related costs. On a

cumulative basis, the Company has incurred $393.8 million of restructuring and impairment expense under the 2009

Restructuring Plan as of December 31, 2013, of which approximately 30% were non-cash.