Harley Davidson 2013 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

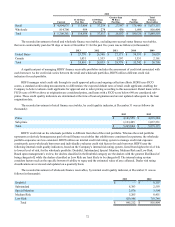

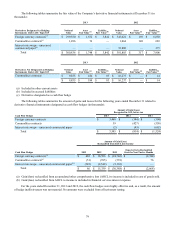

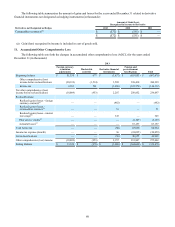

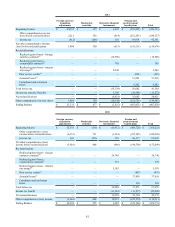

(a) Amounts reclassified to net income are included in motorcycles and related products cost of goods sold.

(b) Amounts reclassified to net income are presented in financial services interest expense.

(c) Amounts reclassified are included in the computation of net periodic period cost. See note 14 for information related

to pension and postretirement benefit plans.

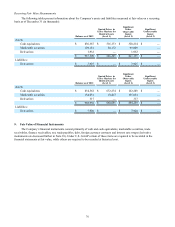

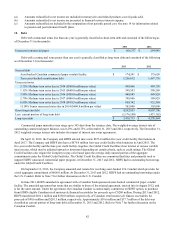

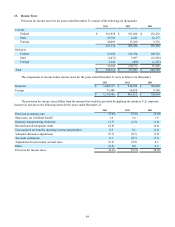

12. Debt

Debt with contractual terms less than one year is generally classified as short-term debt and consisted of the following as

of December 31 (in thousands):

2013 2012

Unsecured commercial paper $ 666,317 $ 294,943

Debt with a contractual term greater than one year is generally classified as long-term debt and consisted of the following

as of December 31 (in thousands):

2013 2012

Secured debt

Asset-backed Canadian commercial paper conduit facility $ 174,241 $ 175,658

Term asset-backed securitization debt 1,256,632 1,447,776

Unsecured notes

5.75% Medium-term notes due in 2014 ($500.0 million par value) 499,866 499,705

1.15% Medium-term notes due in 2015 ($600.0 million par value) 599,543 599,269

3.88% Medium-term notes due in 2016 ($450.0 million par value) 449,883 449,829

2.70% Medium-term notes due in 2017 ($400.0 million par value) 399,946 399,929

6.80% Medium-term notes due in 2018 ($910.5 million par value) 909,742 932,540

15.00% Senior unsecured notes due in 2014 ($600.0 million par value) 303,000 303,000

Gross long-term debt 4,592,853 4,807,706

Less: current portion of long-term debt (1,176,140)(437,162)

Long-term debt $ 3,416,713 $ 4,370,544

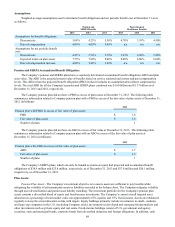

Commercial paper maturities may range up to 365 days from the issuance date. The weighted-average interest rate of

outstanding commercial paper balances was 0.23% and 0.75% at December 31, 2013 and 2012, respectively. The December 31,

2012 weighted-average interest rate includes the impact of interest rate swap agreements.

On April 13, 2012, the Company and HDFS entered into a new $675.0 million five-year credit facility that matures in

April 2017. The Company and HDFS also have a $675.0 million four-year credit facility which matures in April 2015. The

five-year credit facility and the four-year credit facility (together, the Global Credit Facilities) bear interest at various variable

interest rates, which may be adjusted upward or downward depending on certain criteria, such as credit ratings. The Global

Credit Facilities also require the Company to pay a fee based upon the average daily unused portion of the aggregate

commitments under the Global Credit Facilities. The Global Credit Facilities are committed facilities and primarily used to

support HDFS’ unsecured commercial paper program. At December 31, 2013 and 2012, HDFS had no outstanding borrowings

under the Global Credit Facilities.

On September 13, 2013, the Company amended and restated its revolving asset-backed U.S. Conduit which provides for

a total aggregate commitment of $600.0 million. At December 31, 2013 and 2012, HDFS had no outstanding borrowings under

the U.S. Conduit. Refer to Note 7 for further discussion on the U.S. Conduit.

In June 2013, HDFS amended its agreement with a Canadian bank-sponsored asset-backed commercial paper conduit

facility. The amended agreement has terms that are similar to those of the original agreement, entered into in August 2012, and

is for the same amount. Under the agreement, the Canadian Conduit is contractually committed, at HDFS' option, to purchase

from HDFS eligible Canadian retail motorcycle financial receivables for proceeds up to C$200 million. During 2013 and 2012,

HDFS transferred $101.1 million and $230.0 million, respectively, of Canadian retail motorcycle finance receivables for

proceeds of $88.6 million and $201.3 million, respectively. Approximately $38.6 million and $37.7 million of the debt was

classified as current portion of long-term debt at December 31, 2013 and 2012. Refer to Note 7 for further discussion on the

Canadian Conduit.