Harley Davidson 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

111

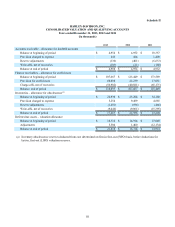

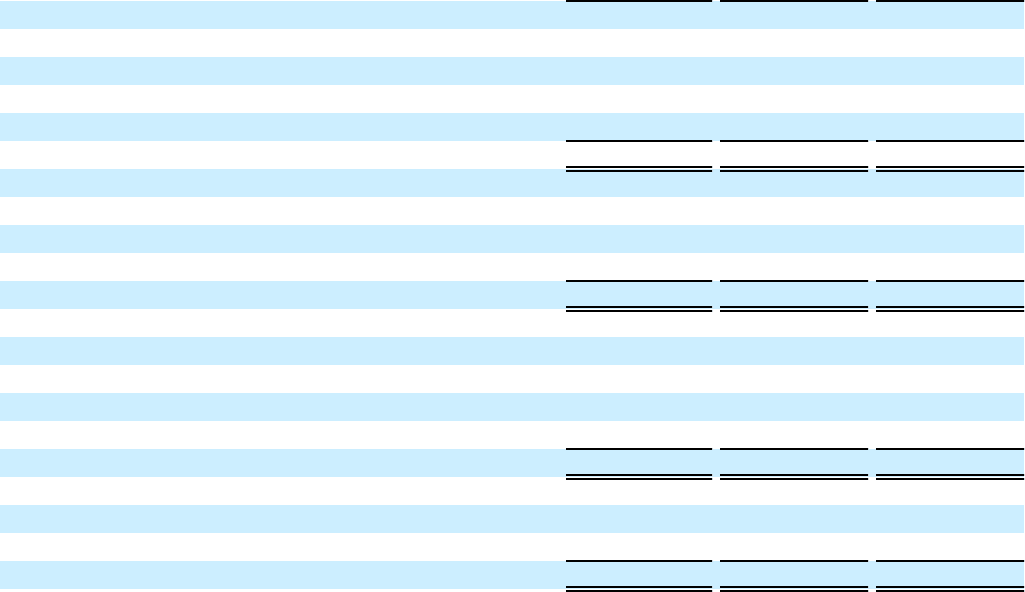

Schedule II

HARLEY-DAVIDSON, INC.

CONSOLIDATED VALUATION AND QUALIFYING ACCOUNTS

Years ended December 31, 2013, 2012 and 2011

(In thousands)

2013 2012 2011

Accounts receivable – allowance for doubtful accounts

Balance at beginning of period $ 4,954 $ 4,952 $ 10,357

Provision charged to expense 245 424 1,408

Reserve adjustments (136)(401)(6,633)

Write-offs, net of recoveries (103)(21)(180)

Balance at end of period $ 4,960 $ 4,954 $ 4,952

Finance receivables – allowance for credit losses

Balance at beginning of period $ 107,667 $ 125,449 $ 173,589

Provision for credit losses 60,008 22,239 17,031

Charge-offs, net of recoveries (56,982)(40,021)(65,171)

Balance, end of period $ 110,693 $ 107,667 $ 125,449

Inventories – allowance for obsolescence(a)

Balance at beginning of period $ 22,936 $ 23,204 $ 34,180

Provision charged to expense 5,254 9,489 4,885

Reserve adjustments (1,281)(696)(466)

Write-offs, net of recoveries (9,446)(9,061)(15,395)

Balance at end of period $ 17,463 $ 22,936 $ 23,204

Deferred tax assets – valuation allowance

Balance at beginning of period $ 16,314 $ 14,914 $ 27,048

Adjustments 5,504 1,400 (12,134)

Balance at end of period $ 21,818 $ 16,314 $ 14,914

(a) Inventory obsolescence reserves deducted from cost determined on first-in first-out (FIFO) basis, before deductions for

last-in, first-out (LIFO) valuation reserves.