Harley Davidson 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

In addition, the Company could experience delays or disruptions in its operations as a result of work stoppages, strikes,

natural causes, terrorism or other factors. Other factors are described in “Risk Factors” under Item 1A which includes a

discussion of additional risk factors and a more complete discussion of some of the cautionary statements noted above.

The Company’s ability to sell its motorcycles and related products and services and to meet its financial expectations also

depends on the ability of the Company’s independent dealers to sell its motorcycles and related products and services to retail

customers. The Company depends on the capability and financial capacity of its independent dealers and distributors to develop

and implement effective retail sales plans to create demand for the motorcycles and related products and services they purchase

from the Company. In addition, the Company’s independent dealers and distributors may experience difficulties in operating

their businesses and selling Harley-Davidson motorcycles and related products and services as a result of weather, economic

conditions or other factors.

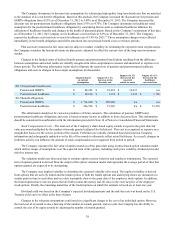

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

The Company is exposed to market risk from changes in foreign exchange rates and interest rates. To reduce such risks,

the Company selectively uses derivative financial instruments. All hedging transactions are authorized and executed pursuant to

regularly reviewed policies and procedures, which prohibit the use of financial instruments for speculative trading purposes.

Sensitivity analysis is used to manage and monitor foreign exchange and interest rate risk.

The Company sells its products internationally and in most markets those sales are made in the foreign country’s local

currency. As a result, the Company’s earnings can be affected by fluctuations in the value of the U.S. dollar relative to foreign

currency. The Company’s most significant foreign currency risk relates to the Euro, the Australian dollar, the Japanese yen and

the Brazilian real. The Company utilizes foreign currency contracts to mitigate the effect of the Euro, the Australian dollar and

the Japanese yen fluctuations on earnings. The foreign currency contracts are entered into with banks and allow the Company

to exchange a specified amount of foreign currency for U.S. dollars at a future date, based on a fixed exchange rate. At

December 31, 2013, the notional U.S. dollar value of outstanding Euro, Australian dollar and Japanese yen foreign currency

contracts was $299.6 million. The Company estimates that a uniform 10% weakening in the value of the U.S. dollar relative to

the currencies underlying these contracts would result in a decrease in the fair value of the contracts of approximately $30.2

million as of December 31, 2013. Further disclosure relating to the fair value of derivative financial instruments is included in

Note 9 of the Notes to Consolidated Financial Statements.