Harley Davidson 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

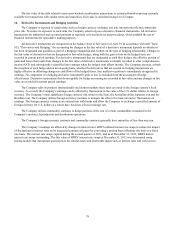

74

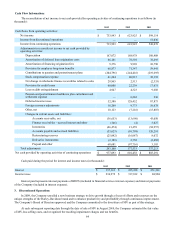

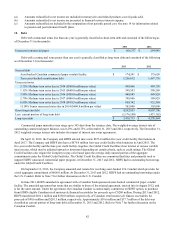

In 2013 and 2012, HDFS transferred $680.6 million and $715.7 million, respectively, of U.S. retail motorcycle

finance receivables to two separate SPEs. The SPEs in turn issued $650.0 million and $675.3 million, respectively, of

secured notes. At December 31, 2013, the Company's consolidated balance sheet included outstanding balances related

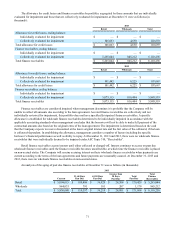

to the following secured notes with the related maturity dates and interest rates (in thousands):

Issue Date

Principal

Amount at Date of

Issuance

Weighted-Average

Rate at Date of

Issuance Contractual Maturity Date

April 2013 $650,000 0.57% May 2014 - December 2020

July 2012 $675,306 0.59% August 2013 - June 2018

November 2011 $513,300 0.88% November 2012 - February 2018

August 2011 $573,380 0.76% September 2012 - August 2017

November 2010 $600,000 1.05% December 2011 - April 2018

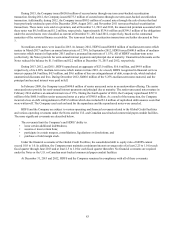

In addition, during 2012, the Company issued $89.5 million of secured notes through the sale of notes that had

been previously retained as part of the December 2009, August 2011 and November 2011 term asset-backed

securitization transactions. These notes were sold at a premium. During 2013, the notes related to the December 2009

term asset-backed securitization transaction were repaid. The remaining notes have contractual maturities ranging from

January 2019 to April 2019.

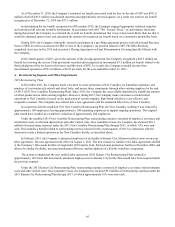

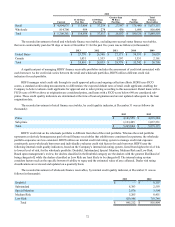

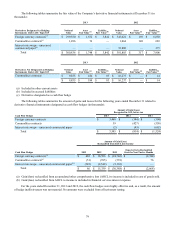

Outstanding balances related to the following secured notes were included in the Company's consolidated balance

sheet at December 31, 2012 (in thousands) and the Company completed repayment of those balances during 2013:

Issue Date

Principal

Amount at Date of

Issuance

Weighted-Average

Rate at Date of

Issuance Contractual Maturity Date

December 2009 $562,499 1.55% December 2010 - June 2017

There are no amortization schedules for the secured notes; however, the debt is reduced monthly as available

collections on the related U.S. retail motorcycle finance receivables are applied to outstanding principal.

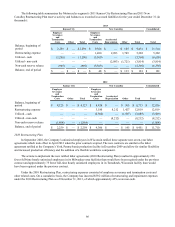

For the year ended December 31, 2013 and 2012, the SPEs recorded interest expense on the secured notes of

$14.5 million and $25.8 million, respectively, which is included in financial services interest expense. The weighted

average interest rate of the outstanding term asset-backed securitization transactions was 0.99% and 1.09% at

December 31, 2013 and 2012, respectively.

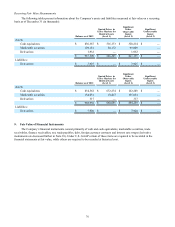

Asset-Backed U.S. Commercial Paper Conduit Facility VIE

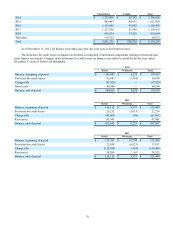

In September 2013, the Company amended and restated its third-party bank sponsored asset-backed commercial

paper conduit facility (U.S. Conduit) which provides for a total aggregate commitment of up to $600.0 million based

on, among other things, the amount of eligible U.S. retail motorcycle finance receivables held by the SPE as collateral.

Under the facility, HDFS may transfer U.S. retail motorcycle finance receivables to a SPE, which in turn may issue debt

to third-party bank-sponsored asset-backed commercial paper conduits.

The assets of the SPE are restricted as collateral for the payment of the debt or other obligations arising in the

transaction and are not available to pay other obligations or claims of the Company’s creditors. The terms for this debt

provide for interest on the outstanding principal based on prevailing commercial paper rates, or LIBOR plus a specified

margin to the extent the advance is not funded by a conduit lender through the issuance of commercial paper. The U.S.

Conduit also provides for an unused commitment fee based on the unused portion of the total aggregate commitment of

$600.0 million. There is no amortization schedule; however, the debt is reduced monthly as available collections on the

related finance receivables are applied to outstanding principal. Upon expiration of the U.S. Conduit, any outstanding

principal will continue to be reduced monthly through available collections. Unless earlier terminated or extended by

mutual agreement of HDFS and the lenders, the U.S. Conduit has an expiration date of September 12, 2014.

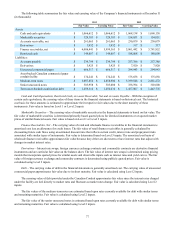

The SPE had no borrowings outstanding under the U.S. Conduit at December 31, 2013 or 2012; therefore, these

assets are restricted as collateral for the payment of fees associated with the unused portion of the total aggregate

commitment of $600.0 million.

For the years ended December 31, 2013 and 2012, the SPE recorded interest expense of $1.2 million and $1.4

million, respectively, related to the unused portion of the total aggregate commitment of $600.0 million. Interest

expense on the U.S. Conduit is included in financial services interest expense. There was no weighted average interest