Harley Davidson 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

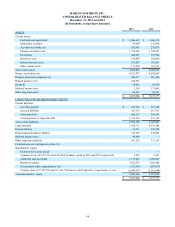

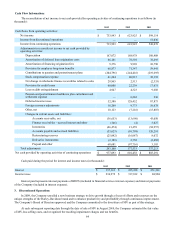

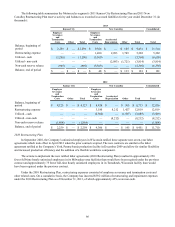

Cash Flow Information:

The reconciliation of net income to net cash provided by operating activities of continuing operations is as follows (in

thousands):

2013 2012 2011

Cash flows from operating activities:

Net income $ 733,993 $ 623,925 $ 599,114

Income from discontinued operations — — 51,036

Income from continuing operations 733,993 623,925 548,078

Adjustments to reconcile net income to net cash provided by

operating activities:

Depreciation 167,072 168,978 180,408

Amortization of deferred loan origination costs 86,181 78,592 78,695

Amortization of financing origination fees 9,376 9,969 10,790

Provision for employee long-term benefits 66,877 71,347 59,441

Contributions to pension and postretirement plans (204,796)(244,416)(219,695)

Stock compensation expense 41,244 40,815 38,192

Net change in wholesale finance receivables related to sales 28,865 2,513 (2,335)

Provision for credit losses 60,008 22,239 17,031

Loss on debt extinguishment 4,947 4,323 9,608

Pension and postretirement healthcare plan curtailment and

settlement expense — 6,242 236

Deferred income taxes 52,580 128,452 87,873

Foreign currency adjustments 16,269 9,773 10,678

Other, net 10,123 (7,216)(15,807)

Changes in current assets and liabilities:

Accounts receivable, net (36,653)(13,690) 43,050

Finance receivables – accrued interest and other (346)(4) 5,027

Inventories (46,474) 21,459 (94,957)

Accounts payable and accrued liabilities (53,623)(10,798) 120,291

Restructuring reserves (25,042)(16,087) 8,072

Derivative instruments (2,189) 2,758 (2,488)

Prepaid and other 68,681 (97,716) 3,103

Total adjustments 243,100 177,533 337,213

Net cash provided by operating activities of continuing operations $ 977,093 $ 801,458 $ 885,291

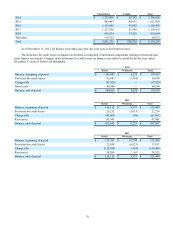

Cash paid during the period for interest and income taxes (in thousands):

2013 2012 2011

Interest $ 197,161 $ 225,228 $ 251,341

Income taxes $ 236,972 $ 317,812 $ 84,984

Interest paid represents interest payments of HDFS (included in financial services interest expense) and interest payments

of the Company (included in interest expense).

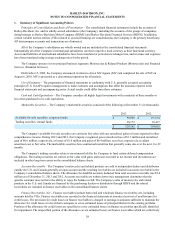

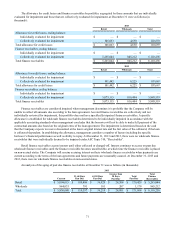

3. Discontinued Operations

In 2009, the Company unveiled a new business strategy to drive growth through a focus of efforts and resources on the

unique strengths of the Harley-Davidson brand and to enhance productivity and profitability through continuous improvement.

The Company’s Board of Directors approved and the Company committed to the divestiture of MV as part of this strategy.

At each subsequent reporting date through the date of sale of MV in August 2010, the Company estimated the fair value

of MV, less selling costs, and recognized the resulting impairment charges and tax benefits.