Harley Davidson 2013 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

108

PART III

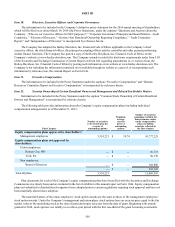

Item 10. Directors, Executive Officers and Corporate Governance

The information to be included in the Company’s definitive proxy statement for the 2014 annual meeting of shareholders,

which will be filed on or about March 14, 2014 (the Proxy Statement), under the captions “Questions and Answers about the

Company – Who are our executive officers for SEC purposes?,” “Corporate Governance Principles and Board Matters – Audit

Committee,” “Election of Directors,” “Section 16(a) Beneficial Ownership Reporting Compliance,” “Audit Committee

Report,” and “Independence of Directors” is incorporated by reference herein.

The Company has adopted the Harley-Davidson, Inc. Financial Code of Ethics applicable to the Company’s chief

executive officer, the chief financial officer, the principal accounting officer and the controller and other persons performing

similar finance functions. The Company has posted a copy of the Harley-Davidson, Inc. Financial Code of Ethics on the

Company’s website at www.harley-davidson.com. The Company intends to satisfy the disclosure requirements under Item 5.05

of the Securities and Exchange Commission’s Current Report on Form 8-K regarding amendments to, or waivers from, the

Harley-Davidson, Inc. Financial Code of Ethics by posting such information on its website at www.harley-davidson.com. The

Company is not including the information contained on or available through its website as a part of, or incorporating such

information by reference into, this Annual Report on Form 10-K.

Item 11. Executive Compensation

The information to be included in the Proxy Statement under the captions “Executive Compensation” and “Human

Resources Committee Report on Executive Compensation” is incorporated by reference herein.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

Information to be included in the Proxy Statement under the caption “Common Stock Ownership of Certain Beneficial

Owners and Management” is incorporated by reference herein.

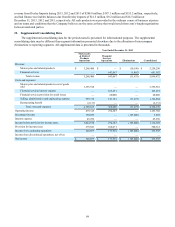

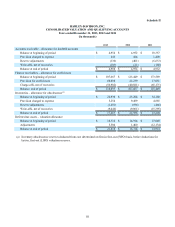

The following table provides information about the Company’s equity compensation plans (including individual

compensation arrangements) as of December 31, 2013:

Plan Category

Number of securities

to be issued upon the

exercise of

outstanding options

Weighted-

average

exercise

price of

outstanding

options

Number of securities

remaining available for

future issuance under

equity compensation

plans (excluding

securities reflected in

the first column)

Equity compensation plans approved by shareholders:

Management employees 3,391,223 $ 39.74 10,777,225

Equity compensation plans not approved by

shareholders:

Union employees:

Kansas City, MO — $ — 26,718

York, PA — $ — 96,770

Non employees:

Board of Directors — $ — 168,880

— $ — 292,368

Total all plans 3,391,223 11,069,593

Plan documents for each of the Company’s equity compensation plans have been filed with the Securities and Exchange

Commission on a timely basis and are included in the list of exhibits to this annual report on Form 10-K. Equity compensation

plans not submitted to shareholders for approval were adopted prior to current regulations requiring such approval and have not

been materially altered since adoption.

The material features of the union employees’ stock option awards are the same as those of the management employees’

stock option awards. Under the Company’s management and union plans, stock options have an exercise price equal to the fair

market value of the underlying stock at the date of grant and expire ten years from the date of grant. Beginning with awards

granted in 2010, stock options vest ratably over a three-year period with the first one-third of the grant becoming exercisable