Harley Davidson 2013 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

tax provision includes amounts sufficient to pay any assessments. Nonetheless, the amounts ultimately paid, if any, upon

resolution of the issues raised by the taxing authorities may differ materially from the amounts accrued for each year.

The Company or one of its subsidiaries files income tax returns in the United States federal and Wisconsin state

jurisdictions and various other state and foreign jurisdictions. The Company is no longer subject to income tax examinations for

Wisconsin state income taxes before 2009 or for United States federal income taxes before 2012.

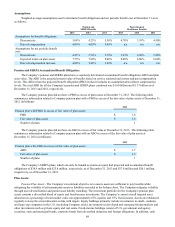

14. Employee Benefit Plans and Other Postretirement Benefits

The Company has a qualified defined benefit pension plan and several postretirement healthcare benefit plans, which

cover employees of the Motorcycles segment. The Company also has unfunded supplemental employee retirement plan

agreements (SERPA) with certain employees which were instituted to replace benefits lost under the Tax Revenue

Reconciliation Act of 1993. During 2012, the Company consolidated four qualified defined benefit pension plans into one

qualified pension plan. The consolidation had no impact on participant benefits.

Pension benefits are based primarily on years of service and, for certain plans, levels of compensation. Employees are

eligible to receive postretirement healthcare benefits upon attaining age 55 after rendering at least 10 years of service to the

Company. Some of the plans require employee contributions to partially offset benefit costs.

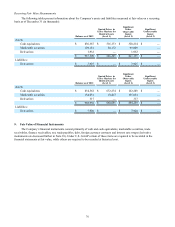

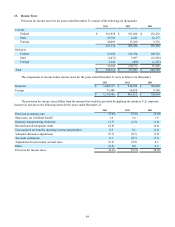

Obligations and Funded Status:

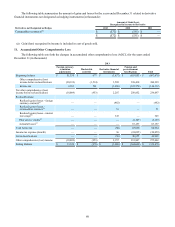

The following table provides the changes in the benefit obligations, fair value of plan assets and funded status of the

Company’s pension, SERPA and postretirement healthcare plans as of the Company’s December 31, 2013 and 2012

measurement dates (in thousands):

Pension and SERPA Benefits Postretirement

Healthcare Benefits

2013 2012 2013 2012

Change in benefit obligation

Benefit obligation, beginning of period $ 1,871,575 $ 1,570,930 $ 403,227 $ 380,625

Service cost 35,987 33,681 7,858 7,413

Interest cost 79,248 83,265 15,599 18,310

Actuarial (gains) losses (199,408) 276,069 (33,729) 23,367

Plan participant contributions — 1,459 2,609 1,561

Benefits paid, net of Medicare Part D subsidy (72,752)(93,829)(29,040)(28,049)

Benefit obligation, end of period 1,714,650 1,871,575 366,524 403,227

Change in plan assets:

Fair value of plan assets, beginning of period 1,539,018 1,253,916 123,106 109,160

Actual return on plan assets 277,388 160,731 24,769 13,946

Company contributions 176,947 216,741 27,849 27,675

Plan participant contributions — 1,459 2,609 1,561

Benefits paid (72,752)(93,829)(30,458)(29,236)

Fair value of plan assets, end of period 1,920,601 1,539,018 147,875 123,106

Funded status of the plans, December 31 $ 205,951 $ (332,557) $ (218,649) $ (280,121)

Amounts recognized in the Consolidated Balance

Sheets, December 31,:

Prepaid benefit costs (long-term assets) $ 244,871 $ — $ — $ —

Accrued benefit liability (current liabilities) (2,549)(2,263)(2,484)(2,059)

Accrued benefit liability (long-term liabilities) (36,371)(330,294)(216,165)(278,062)

Net amount recognized $ 205,951 $ (332,557) $ (218,649) $ (280,121)