Harley Davidson 2013 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.61

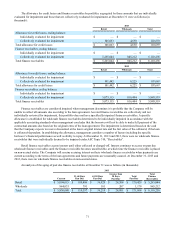

the fair value of derivatives that are designated as fair value hedges, along with the gain or loss on the hedged item, are

recorded in current period earnings. For derivative instruments that are designated as cash flow hedges, the effective portion of

gains and losses that result from changes in the fair value of derivative instruments is initially recorded in other comprehensive

income (OCI) and subsequently reclassified into earnings when the hedged item affects income. The Company assesses, at both

the inception of each hedge and on an on-going basis, whether the derivatives that are used in its hedging transactions are

highly effective in offsetting changes in cash flows of the hedged items. Any ineffective portion is immediately recognized in

earnings. No component of a hedging derivative instrument’s gain or loss is excluded from the assessment of hedge

effectiveness. Derivative instruments that do not qualify for hedge accounting are recorded at fair value and any changes in fair

value are recorded in current period earnings. Refer to Note 10 for a detailed description of the Company’s derivative

instruments.

Motorcycles and Related Products Revenue Recognition – Sales are recorded when products are shipped to wholesale

customers (independent dealers and distributors) and ownership is transferred. The Company may offer sales incentive

programs to both wholesale and retail customers designed to promote the sale of motorcycles and related products. The total

costs of these programs are generally recognized as revenue reductions and are accrued at the later of the date the related sales

are recorded or the date the incentive program is both approved and communicated.

Financial Services Revenue Recognition – Interest income on finance receivables is recorded as earned and is based on

the average outstanding daily balance for wholesale and retail receivables. Accrued and uncollected interest is classified with

finance receivables. Certain loan origination costs related to finance receivables, including payments made to dealers for

certain retail loans, are deferred and amortized over the estimated life of the contract.

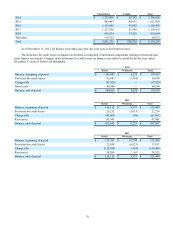

Retail finance receivables are contractually delinquent if the minimum payment is not received by the specified due date.

Retail finance receivables are generally charged-off when the receivable is 120 days or more delinquent, the related asset is

repossessed or the receivable is otherwise deemed uncollectible. All retail finance receivables accrue interest until either

collected or charged-off. Accordingly, as of December 31, 2013 and 2012, all retail finance receivables are accounted for as

interest-earning receivables.

Wholesale finance receivables are delinquent if the minimum payment is not received by the contractual due date.

Interest continues to accrue on past due finance receivables until the date the finance receivable becomes uncollectible and the

finance receivable is placed on non-accrual status. HDFS will resume accruing interest on these accounts when payments are

current according to the terms of the loans and future payments are reasonably assured. While on non-accrual status, all cash

received is applied to principal or interest as appropriate. Wholesale finance receivables are written down once management

determines that the specific borrower does not have the ability to repay the loan in full.

Insurance and protection product commissions as well as commissions on the sale of extended service contracts are

recognized when contractually earned. Deferred revenue related to extended service contracts was $6.8 million and $8.3

million as of December 31, 2013 and 2012, respectively.

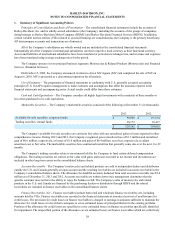

Research and Development Expenses – Expenditures for research activities relating to product development and

improvement are charged against income as incurred and included within selling, administrative and engineering expenses in

the consolidated statement of operations. Research and development expenses were $152.2 million, $137.3 million and $145.4

million for 2013, 2012 and 2011, respectively.

Advertising Costs – The Company expenses the production cost of advertising the first time the advertising takes place.

Advertising costs relate to the Company’s efforts to promote its products and brands through the use of media. During 2013,

2012 and 2011, the Company incurred $90.7 million, $80.7 million and $82.3 million in advertising costs, respectively.

Shipping and Handling Costs – The Company classifies shipping and handling costs as a component of cost of goods

sold.

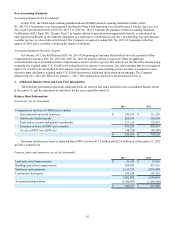

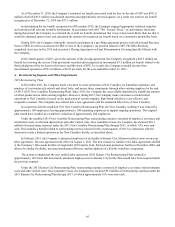

Share-Based Award Compensation Costs – The Company recognizes the cost of its share-based awards in its statement of

operations. The total cost of the Company’s equity awards is equal to their grant date fair value and is recognized as expense on

a straight-line basis over the service periods of the awards. The total cost of the Company’s liability for cash-settled awards is

equal to their settlement date fair value. The liability for cash-settled awards is revalued each period based on a recalculated fair

value adjusted for vested awards. Total share-based award compensation expense recognized by the Company during 2013,

2012 and 2011 was $41.2 million, $40.8 million and $38.2 million, respectively, or $26.0 million, $25.7 million and $24.0

million net of taxes, respectively.

Income Tax Expense – The Company recognizes interest and penalties related to unrecognized tax benefits in the

provision for income taxes.