Harley Davidson 2013 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

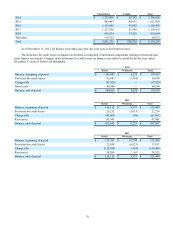

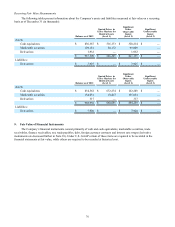

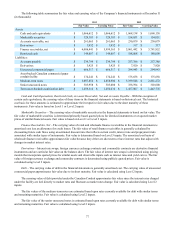

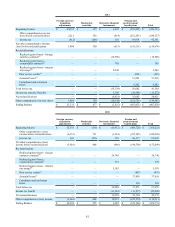

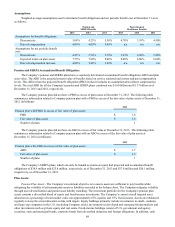

The following tables summarize the fair value of the Company’s derivative financial instruments at December 31 (in

thousands):

2013 2012

Derivatives Designated As Hedging

Instruments Under ASC Topic 815 Notional

Value Asset

Fair Value(a) Liability

Fair Value(b) Notional

Value Asset

Fair Value(a) Liability

Fair Value(b)

Foreign currency contracts(c) $ 299,550 $ 1,672 $ 3,842 $ 345,021 $ 169 $ 6,850

Commodities contracts(c) 1,286 76 — 1,064 148 683

Interest rate swaps – unsecured

commercial paper(c) — — — 35,800 — 373

Total $ 300,836 $ 1,748 $ 3,842 $ 381,885 $ 317 $ 7,906

2013 2012

Derivatives Not Designated As Hedging

Instruments Under ASC Topic 815 Notional

Value Asset

Fair Value(a) Liability

Fair Value(b) Notional

Value Asset

Fair Value(a) Liability

Fair Value(b)

Commodities contracts $ 9,855 $ 184 $ 83 $ 16,237 $ — $ 14

$ 9,855 $ 184 $ 83 $ 16,237 $ — $ 14

(a) Included in other current assets

(b) Included in accrued liabilities

(c) Derivative designated as a cash flow hedge

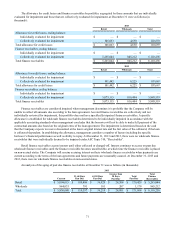

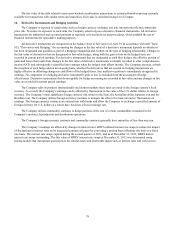

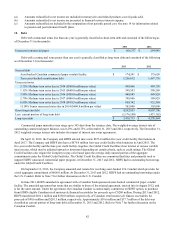

The following tables summarize the amount of gains and losses for the following years ended December 31 related to

derivative financial instruments designated as cash flow hedges (in thousands):

Amount of Gain/(Loss)

Recognized in OCI, before tax

Cash Flow Hedges 2013 2012 2011

Foreign currency contracts $ 3,468 $ (344) $ (304)

Commodities contracts 39 (427)(558)

Interest rate swaps – unsecured commercial paper (2)(43)(662)

Total $ 3,505 $ (814) $ (1,524)

Amount of Gain/(Loss)

Reclassified from AOCL into Income

Cash Flow Hedges 2013 2012 2011 Expected to be Reclassified

Over the Next Twelve Months

Foreign currency contracts(a) $ 482 $ 18,586 $ (24,746) $ (2,744)

Commodities contracts(a) (51)(705)(539) 76

Interest rate swaps – unsecured commercial paper(b) (345)(2,542)(5,103) —

Total $ 86 $ 15,339 $ (30,388) $ (2,668)

(a) Gain/(loss) reclassified from accumulated other comprehensive loss (AOCL) to income is included in cost of goods sold.

(b) Gain/(loss) reclassified from AOCL to income is included in financial services interest expense.

For the years ended December 31, 2013 and 2012, the cash flow hedges were highly effective and, as a result, the amount

of hedge ineffectiveness was not material. No amounts were excluded from effectiveness testing.