Harley Davidson 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

Product Liability Matters:

Additionally, the Company is involved in product liability suits related to the operation of its business. The Company

accrues for claim exposures that are probable of occurrence and can be reasonably estimated. The Company also maintains

insurance coverage for product liability exposures. The Company believes that its accruals and insurance coverage are adequate

and that product liability suits will not have a material adverse effect on the Company’s consolidated financial statements.

Item 4. Mine Safety Disclosures

Not Applicable

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchase of Equity

Securities

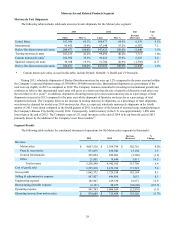

Harley-Davidson, Inc. common stock is traded on the New York Stock Exchange, Inc. The high and low market prices

for the common stock, reported as New York Stock Exchange, Inc. Composite Transactions, were as follows:

2013 Low High 2012 Low High

First quarter $ 48.40 $ 55.51 First quarter $ 38.93 $ 50.96

Second quarter $ 49.15 $ 59.84 Second quarter $ 43.79 $ 54.32

Third quarter $ 53.35 $ 65.15 Third quarter $ 37.84 $ 47.62

Fourth quarter $ 62.76 $ 69.75 Fourth quarter $ 40.59 $ 49.76

The Company paid the following dividends per share:

2013 2012 2011

First quarter $ 0.210 $ 0.155 $ 0.100

Second quarter 0.210 0.155 0.125

Third quarter 0.210 0.155 0.125

Fourth quarter 0.210 0.155 0.125

$ 0.840 $ 0.620 $ 0.475

As of January 31, 2014 there were 80,896 shareholders of record of Harley-Davidson, Inc. common stock.

The following table contains detail related to the repurchase of common stock based on the date of trade during the

quarter ended December 31, 2013:

2013 Fiscal Period Total Number of

Shares Purchased Average Price

Paid per Share

Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs

Maximum Number of

Shares that May Yet Be

Purchased Under the

Plans or Programs

October 1 to November 4 296,142 $ 64 296,142 10,845,427

November 5 to December 2 1,152,888 $ 65 1,152,888 9,795,346

December 3 to December 31 1,216,710 $ 68 1,216,710 8,623,274

Total 2,665,740 $ 66 2,665,740

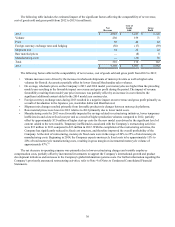

The Company has an authorization (originally adopted in December 1997) by its Board of Directors to repurchase shares

of its outstanding common stock under which the cumulative number of shares repurchased, at the time of any repurchase, shall

not exceed the sum of (1) the number of shares issued in connection with the exercise of stock options occurring on or after

January 1, 2004 plus (2) one percent of the issued and outstanding common stock of the Company on January 1 of the current

year, adjusted for any stock split. No shares were repurchased by the Company during the fourth quarter ended December 31,

2013 under this authorization. As of December 31, 2013, there were 1.8 million shares available under this authorization.

In December 2007, the Company’s Board of Directors separately authorized the Company to buy back up to 20.0 million

shares of its common stock with no dollar limit or expiration date. The Company repurchased 2.7 million shares during the

fourth quarter ended December 31, 2013 under this authorization. As of December 31, 2013, 6.8 million shares remained under

this authorization.