Harley Davidson 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

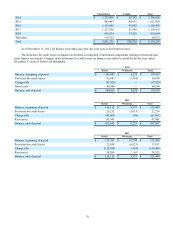

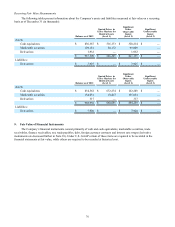

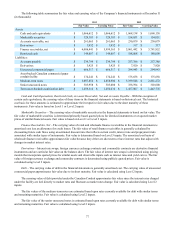

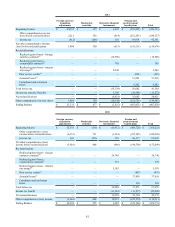

The following table summarizes the fair value and carrying value of the Company’s financial instruments at December 31

(in thousands):

2013 2012

Fair Value Carrying Value Fair Value Carrying Value

Assets:

Cash and cash equivalents $ 1,066,612 $ 1,066,612 $ 1,068,138 $ 1,068,138

Marketable securities $ 129,181 $ 129,181 $ 154,051 $ 154,051

Accounts receivable, net $ 261,065 $ 261,065 $ 230,079 $ 230,079

Derivatives $ 1,932 $ 1,932 $ 317 $ 317

Finance receivables, net $ 6,086,441 $ 5,999,563 $ 5,861,442 $ 5,781,852

Restricted cash $ 144,807 $ 144,807 $ 188,008 $ 188,008

Liabilities:

Accounts payable $ 239,794 $ 239,794 $ 257,386 $ 257,386

Derivatives $ 3,925 $ 3,925 $ 7,920 $ 7,920

Unsecured commercial paper $ 666,317 $ 666,317 $ 294,943 $ 294,943

Asset-backed Canadian commercial paper

conduit facility $ 174,241 $ 174,241 $ 175,658 $ 175,658

Medium-term notes $ 3,087,852 $ 2,858,980 $ 3,199,548 $ 2,881,272

Senior unsecured notes $ 305,958 $ 303,000 $ 338,594 $ 303,000

Term asset-backed securitization debt $ 1,259,314 $ 1,256,632 $ 1,457,807 $ 1,447,776

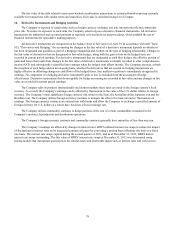

Cash and Cash Equivalents, Restricted Cash, Accounts Receivable, Net and Accounts Payable – With the exception of

certain cash equivalents, the carrying value of these items in the financial statements is based on historical cost. The historical

cost basis for these amounts is estimated to approximate their respective fair values due to the short maturity of these

instruments. Fair value is based on Level 1 or Level 2 inputs.

Marketable Securities – The carrying value of marketable securities in the financial statements is based on fair value. The

fair value of marketable securities is determined primarily based quoted prices for identical instruments or on quoted market

prices of similar financial assets. Fair value is based on Level 1 or Level 2 inputs.

Finance Receivables, Net – The carrying value of retail and wholesale finance receivables in the financial statements is

amortized cost less an allowance for credit losses. The fair value of retail finance receivables is generally calculated by

discounting future cash flows using an estimated discount rate that reflects current credit, interest rate and prepayment risks

associated with similar types of instruments. Fair value is determined based on Level 3 inputs. The amortized cost basis of

wholesale finance receivables approximates fair value because they either are short-term or have interest rates that adjust with

changes in market interest rates.

Derivatives – Interest rate swaps, foreign currency exchange contracts and commodity contracts are derivative financial

instruments and are carried at fair value on the balance sheet. The fair value of interest rate swaps is determined using pricing

models that incorporate quoted prices for similar assets and observable inputs such as interest rates and yield curves. The fair

value of foreign currency exchange and commodity contracts is determined using publicly quoted prices. Fair value is

calculated using Level 2 inputs.

Debt – The carrying value of debt in the financial statements is generally amortized cost. The carrying value of unsecured

commercial paper approximates fair value due to its short maturity. Fair value is calculated using Level 2 inputs.

The carrying value of debt provided under the Canadian Conduit approximates fair value since the interest rates charged

under the facility are tied directly to market rates and fluctuate as market rates change. Fair value is calculated using Level 2

inputs.

The fair values of the medium-term notes are estimated based upon rates currently available for debt with similar terms

and remaining maturities. Fair value is calculated using Level 2 inputs.

The fair value of the senior unsecured notes is estimated based upon rates currently available for debt with similar terms

and remaining maturities. Fair value is calculated using Level 2 inputs.