Harley Davidson 2013 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

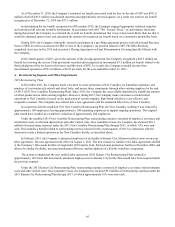

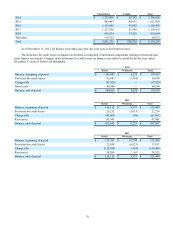

As of December 31, 2010, the Company’s estimated tax benefit associated with the loss on the sale of MV was $101.0

million of which $43.5 million was deemed uncertain and appropriately reserved against. As a result, the total net tax benefit

recognized as of December 31, 2010 was $57.5 million.

In determining the tax benefit recognized as of December 2010, the Company engaged appropriate technical expertise

and considered all relevant available information. In accordance with ASC 740, “Income Taxes,” at each balance sheet date

during this period, the Company re-evaluated the overall tax benefit, determined that it was at least more likely than not that it

would be sustained upon review and calculated the amount of recognized tax benefit based on a cumulative probability basis.

During 2010, the Company voluntarily elected to participate in a pre-filing agreement process with the Internal Revenue

Service (IRS) in order to accelerate the IRS' review of the Company’s tax position related to MV. The IRS effectively

completed its review in late 2011 and executed a Closing Agreement on Final Determination Covering Specific Matters with

the Company.

In the fourth quarter of 2011, given the outcome of the closing agreement, the Company recognized a $43.5 million tax

benefit by reversing the reserve it has previously recorded and recognized an incremental $7.5 million tax benefit related to the

final calculation of the tax basis in the loan to and the stock of MV. As a result, the Company recorded income from

discontinued operations of $51.0 million or $0.22 per share for the year ended December 31, 2011.

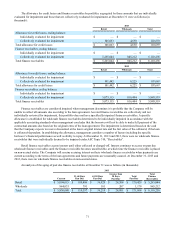

4. Restructuring Expense and Other Impairments

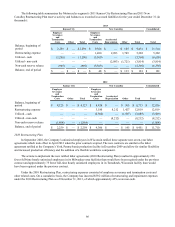

2011 Restructuring Plans

In December 2011, the Company made a decision to cease operations at New Castalloy, its Australian subsidiary and

producer of cast motorcycle wheels and wheel hubs, and source those components through other existing suppliers by the end

of 2013 (2011 New Castalloy Restructuring Plan). Since 2011, the Company has successfully transitioned a significant amount

of wheel production to other existing suppliers. However, during 2013, the Company made a decision to retain limited

operations at New Castalloy focused on the production of certain complex, high-finish wheels in a cost-effective and

competitive manner. The Company also entered into a new agreement with the unionized labor force at New Castalloy.

In connection with the modified 2011 New Castalloy Restructuring Plan, the New Castalloy workforce was reduced by

approximately 100 employees, leaving approximately 100 remaining employees to support ongoing operations. The original

plan would have resulted in a workforce reduction of approximately 200 employees.

Under the modified 2011 New Castalloy Restructuring Plan, restructuring expenses consisted of employee severance and

termination costs, accelerated depreciation and other related costs. On a cumulative basis, the Company has incurred $22.1

million of restructuring expenses under the 2011 New Castalloy Restructuring Plan through 2013, of which 35% were non-

cash. This includes a benefit related to restructuring reserves released in the second quarter of 2013 in connection with the

decision to retain a limited operation at the New Castalloy facility, as described above.

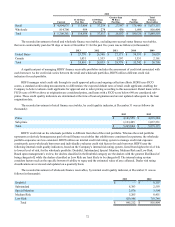

In February 2011, the Company’s unionized employees at its facility in Kansas City, Missouri ratified a new seven-year

labor agreement. The new agreement took effect on August 1, 2011. The new contract is similar to the labor agreements ratified

at the Company’s Wisconsin facilities in September 2010 and its York, Pennsylvania production facility in December 2009, and

allows for similar flexibility, increased production efficiency and the addition of a flexible workforce component.

The actions to implement the new ratified labor agreement (2011 Kansas City Restructuring Plan) resulted in

approximately 145 fewer full-time hourly unionized employees in its Kansas City facility than would have been required under

the previous contract.

Under the 2011 Kansas City Restructuring Plan, restructuring expenses consisted of employee severance and termination

costs and other related costs. On a cumulative basis, the Company has incurred $6.0 million of restructuring expenses under the

2011 Kansas City Restructuring Plan through 2013, of which approximately 10% were non-cash.