Harley Davidson 2013 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

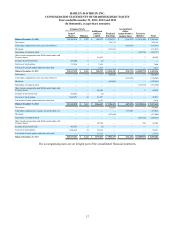

HARLEY-DAVIDSON, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. Summary of Significant Accounting Policies

Principles of Consolidation and Basis of Presentation – The consolidated financial statements include the accounts of

Harley-Davidson, Inc. and its wholly-owned subsidiaries (the Company), including the accounts of the groups of companies

doing business as Harley-Davidson Motor Company (HDMC) and Harley-Davidson Financial Services (HDFS). In addition,

certain variable interest entities (VIEs) related to secured financing are consolidated as the Company is the primary beneficiary.

All intercompany accounts and transactions are eliminated.

All of the Company’s subsidiaries are wholly owned and are included in the consolidated financial statements.

Substantially all of the Company’s international subsidiaries use their respective local currency as their functional currency.

Assets and liabilities of international subsidiaries have been translated at period-end exchange rates, and revenues and expenses

have been translated using average exchange rates for the period.

The Company operates in two principal business segments: Motorcycles & Related Products (Motorcycles) and Financial

Services (Financial Services).

On October 15, 2009, the Company announced its intent to divest MV Agusta (MV) and completed the sale of MV on

August 6, 2010. MV is presented as a discontinued operation for all periods.

Use of Estimates – The preparation of financial statements in conformity with U.S. generally accepted accounting

principles (U.S. GAAP) requires management to make estimates and assumptions that affect the amounts reported in the

financial statements and accompanying notes. Actual results could differ from those estimates.

Cash and Cash Equivalents – The Company considers all highly liquid investments with a maturity of three months or

less when purchased to be cash equivalents.

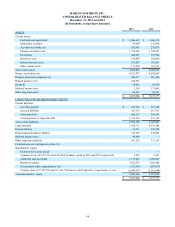

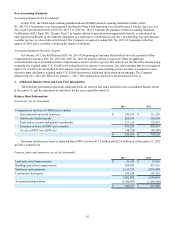

Marketable Securities – The Company’s marketable securities consisted of the following at December 31 (in thousands):

2013 2012

Available-for-sale securities: corporate bonds $ 99,009 $ 135,634

Trading securities: mutual funds 30,172 18,417

$ 129,181 $ 154,051

The Company’s available-for-sale securities are carried at fair value with any unrealized gains or losses reported in other

comprehensive income. During 2013 and 2012, the Company recognized gross unrealized loss of $1.5 million and unrealized

gain of $0.6 million, respectively, or losses of $1.0 million and gains of $0.4 million, net of tax, respectively, to adjust

amortized cost to fair value. The marketable securities have contractual maturities that generally come due over the next 1 to 29

months.

The Company's trading securities relate to investments held by the Company to fund certain deferred compensation

obligations. The trading securities are carried at fair value with gains and losses recorded in net income and investments are

included in other long-term assets on the consolidated balance sheets.

Accounts Receivable – The Company’s motorcycles and related products are sold to independent dealers and distributors

outside the U.S. and Canada generally on open account and the resulting receivables are included in accounts receivable in the

Company’s consolidated balance sheets. The allowance for doubtful accounts deducted from total accounts receivable was $5.0

million as of December 31, 2013 and 2012. Accounts receivable are written down once management determines that the

specific customer does not have the ability to repay the balance in full. The Company’s sales of motorcycles and related

products in the U.S. and Canada are financed by the purchasing dealers or distributors through HDFS and the related

receivables are included in finance receivables in the consolidated balance sheets.

Finance Receivables, Net – Finance receivables include both retail and wholesale finance receivables, net, including

amounts held by VIEs. Finance receivables are recorded in the financial statements at amortized cost net of an allowance for

credit losses. The provision for credit losses on finance receivables is charged to earnings in amounts sufficient to maintain the

allowance for credit losses at a level that is adequate to cover estimated losses of principal inherent in the existing portfolio.

Portions of the allowance for credit losses are specified to cover estimated losses on finance receivables specifically identified

for impairment. The unspecified portion of the allowance covers estimated losses on finance receivables which are collectively