Harley Davidson 2013 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2013 Harley Davidson annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.21

On February 5, 2014, the Company announced that the Company's Board had authorized the Company to repurchase up

to 20.0 million shares of its common stock with no dollar limit or expiration date. This board authorization is in addition to

existing share repurchase authorizations.

Under the share repurchase authorizations, the Company’s common stock may be purchased through any one or more of

a Rule 10b5-1 trading plan and discretionary purchases on the open market, block trades, accelerated share repurchases or

privately negotiated transactions. The number of shares repurchased, if any, and the timing of repurchases will depend on a

number of factors, including share price, trading volume and general market conditions, as well as on working capital

requirements, general business conditions and other factors. The repurchase authority has no expiration date but may be

suspended, modified or discontinued at any time.

The Harley-Davidson, Inc. 2009 Incentive Stock Plan (exhibit 10.5) and predecessor stock plans permit participants to

satisfy all or a portion of the statutory federal, state and local withholding tax obligations arising in connection with plan

awards by electing to (a) have the Company withhold Shares otherwise issuable under the award, (b) tender back shares

received in connection with such award or (c) deliver other previously owned Shares, in each case having a value equal to the

amount to be withheld. During the fourth quarter of 2013, the Company acquired 10,475 shares of common stock that

employees presented to the Company to satisfy withholding taxes in connection with the vesting of restricted stock awards.

Item 12 of this Annual Report on Form 10-K contains certain information relating to the Company’s equity compensation

plans.

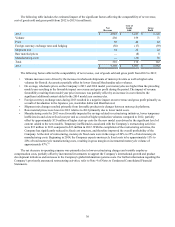

The following information in this Item 5 is not deemed to be “soliciting material” or to be “filed” with the SEC or subject

to Regulation 14A or 14C under the Securities Exchange Act of 1934 or to the liabilities of Section 18 of the Securities

Exchange Act of 1934, and will not be deemed to be incorporated by reference into any filing under the Securities Act of 1933

or the Securities Exchange Act of 1934, except to the extent the Company specifically incorporates it by reference into such a

filing: the SEC requires the Company to include a line graph presentation comparing cumulative five year Common Stock

returns with a broad-based stock index and either a nationally recognized industry index or an index of peer companies selected

by the Company. The Company has chosen to use the Standard & Poor’s 500 Index as the broad-based index and the

Standard & Poor’s MidCap 400 Index as a more specific comparison. The Standard & Poor’s MidCap 400 Index was chosen

because the Company does not believe that any other published industry or line-of-business index adequately represents the

current operations of the Company. The graph assumes a beginning investment of $100 on December 31, 2008 and that all

dividends are reinvested.