GameStop 2010 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

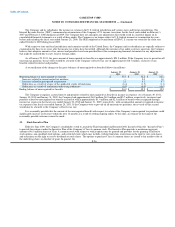

The Company and its subsidiaries file income tax returns in the U.S. federal jurisdiction and various states and foreign jurisdictions. The

Internal Revenue Service ("IRS") commenced an examination of the Company's U.S. income tax returns for the fiscal years ended on February 3,

2007 and February 2, 2008 during fiscal 2009. The Company does not anticipate any adjustments that would result in a material impact on its

consolidated financial statements as a result of these audits. The Company is no longer subject to U.S. federal income tax examination for years

before and including the fiscal year ended January 28, 2006. The IRS completed an examination of EB's U.S. income tax return for the short year

ended October 8, 2005 during fiscal 2009.

With respect to state and local jurisdictions and countries outside of the United States, the Company and its subsidiaries are typically subject to

examination for three to six years after the income tax returns have been filed. Although the outcome of tax audits is always uncertain, the Company

believes that adequate amounts of tax, interest and penalties have been provided for in the accompanying financial statements for any adjustments

that might be incurred due to state, local or foreign audits.

As of January 29, 2011, the gross amount of unrecognized tax benefits was approximately $24.9 million. If the Company were to prevail on all

uncertain tax positions, the net effect would be a benefit to the Company's effective tax rate of approximately $18.7 million, exclusive of any

benefits related to interest and penalties.

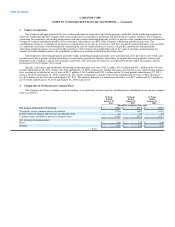

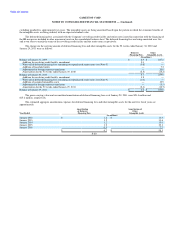

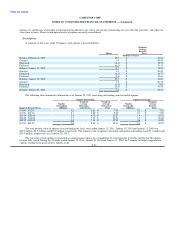

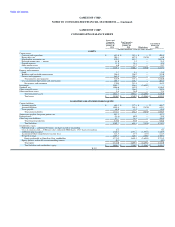

A reconciliation of the changes in the gross balances of unrecognized tax benefits follows (in millions):

January 29, January 30, January 31,

2011 2010 2009

Beginning balance of unrecognized tax benefits $ 35.2 $ 32.2 $ 24.2

Increases related to current period tax positions — 5.0 1.0

Increases related to prior period tax positions 2.1 8.1 8.7

Reductions as a result of a lapse of the applicable statute of limitations (6.4) (1.5) (1.1)

Reductions as a result of settlements with taxing authorities (6.0) (8.6) (0.6)

Ending balance of unrecognized tax benefits $ 24.9 $ 35.2 $ 32.2

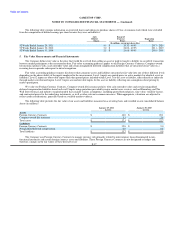

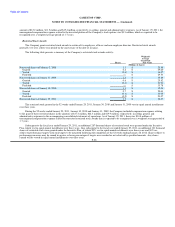

The Company recognizes accrued interest and penalties related to unrecognized tax benefits in income tax expense. As of January 29, 2011,

January 30, 2010 and January 31, 2009, the Company had approximately $6.2 million, $6.9 million and $5.7 million, respectively, in interest and

penalties related to unrecognized tax benefits accrued of which approximately $1.4 million and $2.3 million of benefit were recognized through

income tax expense in the fiscal years ended January 30, 2010 and January 31, 2009, respectively, with an immaterial amount recognized in income

tax expense in the fiscal year ended January 29, 2011. If the Company were to prevail on all uncertain tax positions, the reversal of this accrual

would also be a benefit to the Company's effective tax rate.

It is reasonably possible that the amount of the unrecognized benefit with respect to certain of the Company's unrecognized tax positions could

significantly increase or decrease within the next 12 months as a result of settling ongoing audits. At this time, an estimate of the range of the

reasonably possible outcomes cannot be made.

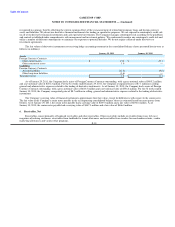

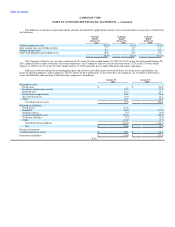

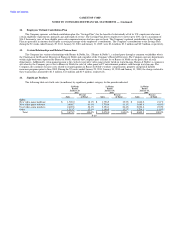

13. Stock Incentive Plan

Effective June 2009, the Company's stockholders voted to amend the Third Amended and Restated 2001 Incentive Plan (the "Incentive Plan")

to provide for issuance under the Incentive Plan of the Company's Class A common stock. The Incentive Plan provides a maximum aggregate

amount of 46.5 million shares of Class A common stock with respect to which options may be granted and provides for the granting of incentive

stock options, non-qualified stock options, and restricted stock, which may include, without limitation, restrictions on the right to vote such shares

and restrictions on the right to receive dividends on such shares. The options to purchase Class A common shares are issued at fair market value of

the underlying shares on the date of grant. In general, the F-26