GameStop 2010 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

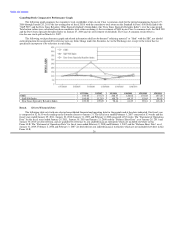

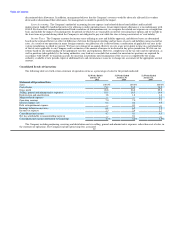

GameStop Stock Comparative Performance Graph

The following graph compares the cumulative total stockholder return on our Class A common stock for the period commencing January 27,

2006 through January 28, 2011 (the last trading date of fiscal 2010) with the cumulative total return on the Standard & Poor's 500 Stock Index (the

"S&P 500") and the Dow Jones Retailers, Other Specialty Industry Group Index (the "Dow Jones Specialty Retailers Index") over the same period.

Total return values were calculated based on cumulative total return assuming (i) the investment of $100 in our Class A common stock, the S&P 500

and the Dow Jones Specialty Retailers Index on January 27, 2006 and (ii) reinvestment of dividends. The Class A common stock reflects a

two-for-one stock split on March 16, 2007.

The following stock performance graph and related information shall not be deemed "soliciting material" or "filed" with the SEC, nor should

such information be incorporated by reference into any future filings under the Securities Act or the Exchange Act, except to the extent that we

specifically incorporate it by reference in such filing.

1/27/2006 2/2/2007 2/1/2008 1/30/2009 1/29/2010 1/28/2011

GME 100.00 137.71 268.37 126.62 101.02 107.20

S&P 500 Index 100.00 112.83 108.70 64.33 83.65 99.43

Dow Jones Specialty Retailers Index 100.00 109.20 98.44 61.69 89.16 118.48

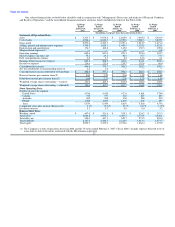

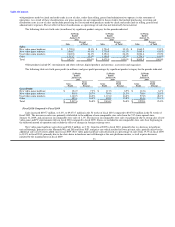

Item 6. Selected Financial Data

The following table sets forth our selected consolidated financial and operating data for the periods and at the dates indicated. Our fiscal year

is composed of 52 or 53 weeks ending on the Saturday closest to January 31. The fiscal year ended February 3, 2007 consisted of 53 weeks and the

fiscal years ended January 29, 2011, January 30, 2010, January 31, 2009 and February 2, 2008 consisted of 52 weeks. The "Statement of Operations

Data" for the fiscal years ended January 29, 2011, January 30, 2010 and January 31, 2009 and the "Balance Sheet Data" as of January 29, 2011 and

January 30, 2010 are derived from, and are qualified by reference to, our audited financial statements which are included elsewhere in this

Form 10-K. The "Statement of Operations Data" for fiscal years ended February 2, 2008 and February 3, 2007 and the "Balance Sheet Data" as of

January 31, 2009, February 2, 2008 and February 3, 2007 are derived from our audited financial statements which are not included elsewhere in this

Form 10-K. 26