GameStop 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

There may be possible changes in our global tax rate.

As a result of our operations in many foreign countries, our global tax rate is derived from a combination of applicable tax rates in the various

jurisdictions in which we operate. Depending upon the sources of our income, any agreements we may have with taxing authorities in various

jurisdictions and the tax filing positions we take in various jurisdictions, our overall tax rate may be higher than other companies or higher than our

tax rates have been in the past. We base our estimate of an annual effective tax rate at any given point in time on a calculated mix of the tax rates

applicable to our Company and to estimates of the amount of income to be derived in any given jurisdiction. A change in the mix of our business

from year to year and from country to country, changes in rules related to accounting for income taxes, changes in tax laws in any of the multiple

jurisdictions in which we operate or adverse outcomes from the tax audits that regularly are in process in any jurisdiction in which we operate could

result in an unfavorable change in our overall tax rate, which could have a material adverse effect on our business and results of our operations.

If we are unable to renew or enter into new leases on favorable terms, our revenue growth may decline.

All of our retail stores are located in leased premises. If the cost of leasing existing stores increases, we cannot assure you that we will be able

to maintain our existing store locations as leases expire. In addition, we may not be able to enter into new leases on favorable terms or at all, or we

may not be able to locate suitable alternative sites or additional sites for new store expansion in a timely manner. Our revenues and earnings may

decline if we fail to maintain existing store locations, enter into new leases, locate alternative sites or find additional sites for new store expansion.

Restrictions on our ability to take trade-ins of and sell used video game products could negatively affect our financial condition and results of

operations.

Our financial results depend on our ability to take trade-ins of, and sell, used video game products within our stores. Actions by manufacturers

or publishers of video game products or governmental authorities to limit our ability to take trade-ins or sell used video game products could have a

negative impact on our sales and earnings.

If we fail to keep pace with changing industry technology, we will be at a competitive disadvantage.

The interactive entertainment industry is characterized by swiftly changing technology, evolving industry standards, frequent new and

enhanced product introductions and product obsolescence. These characteristics require us to respond quickly to technological changes and to

understand their impact on our customers' preferences. If we fail to keep pace with these changes, our business may suffer.

Technological advances in the delivery and types of video games and PC entertainment software, as well as changes in consumer behavior

related to these new technologies, could lower our sales.

While it is currently only possible to download a limited amount of video game content to the next generation video game systems and

downloading is constrained by bandwidth capacity, this technology is becoming more prevalent. If advances in technology continue to expand our

customers' ability to access and download the current format of video games, PC entertainment software and incremental content for their games

through these and other sources, our customers may no longer choose to purchase video games or PC entertainment software in our stores or reduce

their purchases in favor of other forms of game delivery. As a result, sales and earnings could decline. While the Company is currently pursuing

various strategies to integrate these new delivery methods and competing content into the Company's business model, including hiring employees

with experience in digital gaming and making investments in and acquisitions of digital gaming and technology-based companies, we can provide no

assurances that these strategies will be successful or profitable.

An adverse trend in sales during the holiday selling season could impact our financial results.

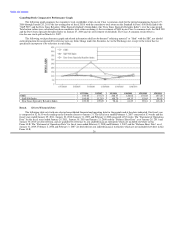

Our business, like that of many retailers, is seasonal, with the major portion of our sales and operating profit realized during the fourth fiscal

quarter, which includes the holiday selling season. During fiscal 2010, we generated approximately 39% of our sales and approximately 57% of our

operating earnings during the fourth quarter. Any 18