GameStop 2010 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

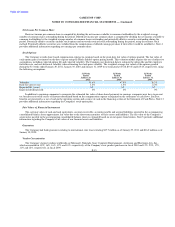

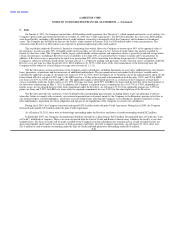

New Accounting Pronouncements

In January 2010, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") ASU 2010-6, Improving

Disclosures About Fair Value Measurements. On January 31, 2010, the Company adopted ASU 2010-6, which requires reporting entities to make

new disclosures about recurring or nonrecurring fair-value measurements, including significant transfers into and out of the standard's Level 1 and

Level 2 fair-value measurements and information on purchases, sales, issuances, and settlements on a gross basis for Level 3 fair-value

measurements. ASU 2010-6 is effective for annual reporting periods beginning after December 15, 2009, except for Level 3 reconciliation

disclosures which are effective for annual periods beginning after December 15, 2010. The adoption of ASU 2010-6 did not have a material impact

on the Company's consolidated financial statements.

On January 31, 2010, the Company adopted ASU 2010-09, Subsequent Events — Amendments to Certain Recognition and Disclosure

Requirements, which amends Accounting Standards Codification ("ASC") Topic 855, Subsequent Events, so that Securities and Exchange

Commission filers no longer are required to disclose the date through which subsequent events have been evaluated in originally issued and revised

financial statements. The adoption of ASU 2010-09 did not have a material impact on the Company's consolidated financial statements.

In December 2010, the FASB issued ASU 2010-28, Intangibles — Goodwill and Other. ASU 2010-28 modifies step one of the goodwill

impairment test for reporting units with zero or negative carrying amounts and offers guidance on when to perform step two of the testing. For those

reporting units, an entity is required to perform step two of the goodwill impairment test if it is more likely than not that a goodwill impairment

exists based upon factors such as unanticipated competition, the loss of key personnel and adverse regulatory changes. ASU 2010-28 is effective for

fiscal years, and interim periods within those years, beginning after December 15, 2010. The adoption of ASU 2010-28 is not expected to have a

material effect on the Company's consolidated financial statements.

In December 2010, the FASB issued ASU 2010-29, which updates the guidance in ASC 805, Business Combinations, to clarify that pro forma

disclosures should be presented as if a business combination occurred at the beginning of the prior annual period for purposes of preparing both the

current reporting period and the prior reporting period pro forma financial information. These disclosures should be accompanied by a narrative

description about the nature and amount of material, nonrecurring pro forma adjustments. ASU 2010-29 is effective for business combinations

consummated in periods beginning after December 15, 2010, and is required to be applied prospectively as of the date of adoption. The adoption of

ASU 2010-29 is not expected to have a material effect on the Company's consolidated financial statements.

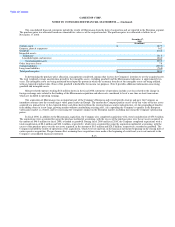

2. Acquisitions

On November 17, 2008, GameStop France SAS, a wholly-owned subsidiary of the Company, completed the acquisition of substantially all of

the outstanding capital stock of Micromania for $580.4 million, net of cash acquired. Micromania is a leading retailer of video and computer games

in France with 379 locations, 328 of which were operating upon acquisition. The Company funded the transaction with cash on hand, funds drawn

against its then existing $400 million revolving credit agreement totaling $275 million, and term loans totaling $150 million under a junior term loan

facility (the "Term Loans"). As of January 31, 2009, all of the borrowings against the revolving credit agreement and the Term Loans had been

repaid. The purpose of the acquisition was to expand the Company's presence in Europe. The impact of the acquisition on the Company's results of

operations, as if the acquisition had been completed as of the beginning of the periods presented, is not significant.

F-14