GameStop 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

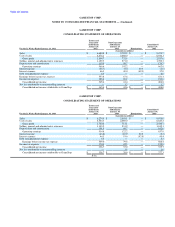

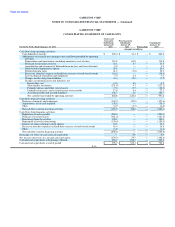

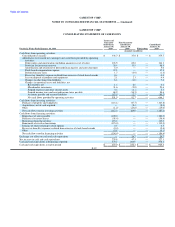

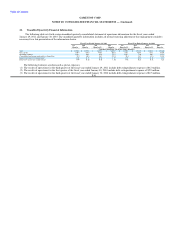

GAMESTOP CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

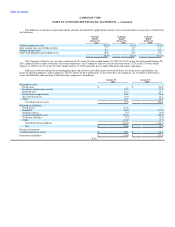

of the Company approved an additional $300 million share repurchase program authorizing the Company to repurchase its common stock. For fiscal

2010, the number of shares repurchased were 17.1 million for an average price per share of $19.84. Approximately $22.0 million of treasury share

purchases were not settled at the end of fiscal 2010 and were reported in accrued liabilities at January 29, 2011. Additionally, approximately

$64.6 million of treasury share purchases were not settled at the end of fiscal 2009 and were reported in accrued liabilities at January 30, 2010. On

February 4, 2011, the Board of Directors of the Company authorized a $500 million repurchase fund to be used for share repurchases of its common

stock and/or to retire the Company's Senior Notes. This plan replaced the $300 million share repurchase program authorized in September 2010

which had $138.4 million remaining. As of March 24, 2011, the Company has purchased an additional 5.9 million shares for an average price per

share of $19.88.

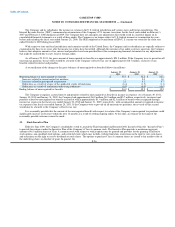

20. Consolidating Financial Statements

In order to finance the EB merger, as described in Note 9, on September 28, 2005, the Company, along with GameStop, Inc. as co-issuer,

completed the offering of the Notes. The direct and indirect domestic wholly-owned subsidiaries of the Company, excluding GameStop, Inc., as co-

issuer, have guaranteed the Senior Notes on a senior unsecured basis with unconditional guarantees.

F-33