GameStop 2010 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

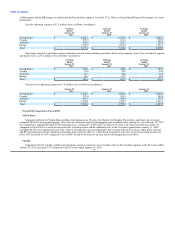

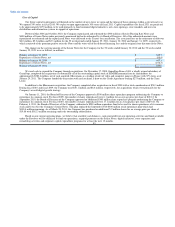

Contractual Obligations

The following table sets forth our contractual obligations as of January 29, 2011:

Payments Due by Period

Less Than More Than

Contractual Obligations Total 1 Year 1-3 Years 3-5 Years 5 Years

(In millions)

Long-Term Debt(1) $ 290.0 $ 20.0 $ 270.0 $ — $ —

Operating Leases 1,337.6 350.7 492.2 231.8 262.9

Purchase Obligations(2) 903.7 903.7 — — —

Total $ 2,531.3 $ 1,274.4 $ 762.2 $ 231.8 $ 262.9

(1) The long-term debt consists of $250.0 million (principal value), which bears interest at 8.0% per annum. Amounts include contractual interest

payments.

(2) Purchase obligations represent outstanding purchase orders for merchandise from vendors. These purchase orders are generally cancelable until

shipment of the products.

In addition to minimum rentals, the operating leases generally require the Company to pay all insurance, taxes and other maintenance costs

and may provide for percentage rentals. Percentage rentals are based on sales performance in excess of specified minimums at various stores. Leases

with step rent provisions, escalation clauses or other lease concessions are accounted for on a straight-line basis over the lease term, including

renewal options for those leases in which it is reasonably assured that the Company will exercise the renewal option. The Company does not have

leases with capital improvement funding.

The Company has entered into employment agreements with Daniel A. DeMatteo, Executive Chairman; R. Richard Fontaine, Chairman

International; J. Paul Raines, Chief Executive Officer; Tony D. Bartel, President and Robert A. Lloyd, Executive Vice President and Chief Financial

Officer. The term of the employment agreement with Mr. DeMatteo commenced on April 11, 2005, when he was Chief Operating Officer of the

Company, and was renewed in April 2010 with an expiration date of March 3, 2013. The term of the employment agreement with Mr. Fontaine

commenced on April 11, 2005, when he was Chairman and Chief Executive Officer of the Company, and was renewed in April 2010 with an

expiration date of March 3, 2013. The term of the employment agreement for Mr. Raines commenced on September 7, 2008 and continues for a

period of three years thereafter. The term of the employment agreement for Mr. Bartel commenced on October 24, 2008 and continues for a period

of three years thereafter. The term of the employment agreement for Mr. Lloyd commenced on June 2, 2010 and continues for a period of three years

thereafter.

Each of the employment agreements was amended on February 9, 2011 to eliminate the right of each executive to terminate his employment

agreement as a result of a change-in-control of the Company. The amendments also eliminated the automatic renewal provision of each agreement,

except for Mr. Fontaine, whose agreement does not contain an automatic renewal provision. The minimum annual salaries during the term of

employment under the amended and restated employment agreements for Messrs. DeMatteo, Fontaine, Raines, Bartel and Lloyd shall be no less

than $1,250,000, $600,000, $1,000,000, $750,000 and $500,000, respectively. The Board of Directors of the Company has set the annual salaries of

Messrs. DeMatteo, Raines, Bartel and Lloyd for fiscal 2011 at $1,250,000, $1,030,000, $775,000 and $550,000, respectively. The employment

agreement for Mr. Fontaine stipulates that his annual salary for the period between March 27, 2011 and March 3, 2013 will be $600,000.

As of January 29, 2011, we had standby letters of credit outstanding in the amount of $8.2 million and had bank guarantees outstanding in the

amount of $17.7 million, $6.1 million of which are cash collateralized.

As of January 29, 2011, the Company had $24.9 million of income tax liability, including accrued interest and penalties related to

unrecognized tax benefits in other long-term liabilities in its consolidated balance sheet. At the time of this filing, the settlement period for the

noncurrent portion of our income tax liability cannot be determined. In addition, any payments related to unrecognized tax benefits would be

partially offset by reductions in payments in other jurisdictions. 44