GameStop 2010 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

www.gamestop.ie, www.gamestop.de and www.micromania.fr and the online video gaming Web site www.kongregate.com.

• Increase Sales of Used Video Game Products. We believe we are the largest retailer of used video game products in the world and carry

the broadest selection of used video game products for both current and previous generation platforms, giving us a unique advantage in

the video game retail industry. The opportunity to trade in and purchase used video game products offers our customers a unique value

proposition generally unavailable at most mass merchants, toy stores and consumer electronics retailers. We obtain most of our used

video game products from trade-ins made in our stores by our customers. We will continue to expand the selection and availability of

used video game products in our stores. Used video game products generate significantly higher gross margins than new video game

products. Our strategy consists of increasing consumer awareness of the benefits of trading in and buying used video game products at

our stores through increased marketing activities and the use of both broad and targeted marketing to our PowerUp Rewards members.

We expect the continued sale of new platform technology and software to drive trade-ins of previous generation products, as well as

trade-ins of next generation platform products, thereby expanding the supply of used video game products.

• Capitalize on Growth in Demand. While sales of new video game hardware decreased from fiscal 2009 to fiscal 2010, our customer

base has expanded. Our sales of new video game software and used video game products grew by approximately 6% and 3%,

respectively, in fiscal 2010 primarily due to new store growth and the expansion of the hardware platform customer base. In addition,

our other product sales increased 10% in fiscal 2010 primarily due to the strong sell-through of new PC entertainment software and the

growth of online game card sales. Our sales of new video game software and used video game products grew by approximately 1% and

18%, respectively, in fiscal 2009 primarily due to new store growth, the acquisition of Micromania and the acceptance of used video

game products internationally.

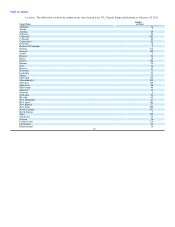

• Store Opening/Closing Strategy. The Company has an analysis-driven approach to store opening and closing decisions. We intend to

continue to open new stores in targeted markets where we do not currently have a presence and can take market-share from an uncontested

competitor. Likewise, we will be aggressive in the analysis of our existing store base to determine optimal levels of profitability and close

stores where profitability goals are not being met or where we can attempt to transfer sales to other nearby existing stores and increase

overall profits. We opened 359 new stores and closed 139 stores in fiscal 2010. We opened 388 new stores and closed 145 stores in fiscal

2009. We opened 674 new stores and closed 59 stores in fiscal 2008 and acquired 328 stores in France. On average, our new stores opened

in the past three fiscal years have had a return of original investment of less than two years. We plan to open approximately 300 new stores

and close approximately 200 stores in fiscal 2011. Our primary growth vehicles will be the expansion of our strip center store base in the

United States and the expansion of our international store base. Our strategy within the U.S., Canada and Australia is to open strip center

stores in targeted markets where we do not currently have a presence and close stores where we can improve profitability either by

transferring sales to other nearby stores or vacating a location. Our strategy in Europe is to continue expansion in locations with a

demonstrated track record of successful new store openings and increasing returns on invested capital. We analyze each market relative to

target population and other demographic indices, real estate availability, competitive factors and past operating history, if available. In some

cases, these new stores may adversely impact sales at existing stores, but our goal is to minimize the impact.

Expand our Digital Growth Strategy to Protect and Expand our Market Leadership Position. We expect that future growth in the video game

industry will be driven by the sale of video games delivered in digital form and the expansion of other forms of gaming. We currently sell various

types of products that relate to the digital category, including Xbox Live, PlayStation and Nintendo network point cards, as well as prepaid digital

and online timecards and digitally downloadable software. We operate an online video game platform called Kongregate.com which we acquired in

August 2010. We continue to make significant investments in e-commerce, digital delivery systems, online video game aggregation, digital kiosks

and in-store and Web site functionality to enable our customers to access digital content and eliminate friction in the digital sales and delivery

process. We plan to continue to invest in 6