GameStop 2010 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

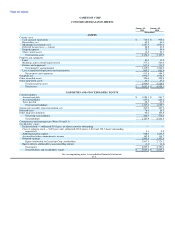

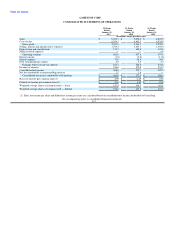

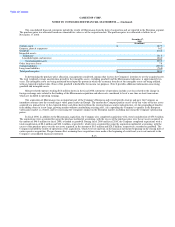

GAMESTOP CORP.

CONSOLIDATED STATEMENTS OF CASH FLOWS

52 Weeks 52 Weeks 52 Weeks

Ended Ended Ended

January 29, January 30, January 31,

2011 2010 2009

(In millions)

Cash flows from operating activities:

Consolidated net income $ 406.8 $ 375.7 $ 398.3

Adjustments to reconcile net earnings to net cash flows provided by operating activities:

Depreciation and amortization (including amounts in cost of sales) 176.8 164.1 146.4

Provision for inventory reserves 27.5 48.9 43.0

Amortization and retirement of deferred financing fees and issue discounts 5.0 5.0 3.7

Stock-based compensation expense 29.6 37.8 35.4

Deferred income taxes 38.2 (1.2) (24.7)

Excess tax (benefits) expense realized from exercise of stock-based awards (18.6) 0.4 (34.2)

Loss on disposal of property and equipment 7.6 4.4 5.2

Changes in other long-term liabilities (7.2) 7.6 7.4

Changes in operating assets and liabilities, net

Receivables, net 0.2 4.2 (2.9)

Merchandise inventories (227.2) 29.6 (209.5)

Prepaid expenses and other current assets (10.5) 2.3 (16.4)

Prepaid income taxes and accrued income taxes payable 22.3 54.6 43.9

Accounts payable and accrued liabilities 140.7 (89.2) 153.6

Net cash flows provided by operating activities 591.2 644.2 549.2

Cash flows from investing activities:

Purchase of property and equipment (197.6) (163.8) (183.2)

Acquisitions, net of cash acquired (38.1) (8.4) (630.7)

Other (4.4) (15.0) (7.0)

Net cash flows used in investing activities (240.1) (187.2) (820.9)

Cash flows from financing activities:

Repurchase of notes payable (200.0) (100.0) (30.0)

Purchase of treasury shares (381.2) (58.4) —

Borrowings from the revolver 120.0 115.0 —

Repayment of revolver borrowings (120.0) (115.0) —

Borrowings for acquisition — — 425.0

Repayments of acquisition borrowings — — (425.0)

Issuance of shares relating to stock options 10.8 4.5 28.9

Excess tax benefits (expense) realized from exercise of stock-based awards 18.6 (0.4) 34.2

Other (3.8) (0.1) (3.5)

Net cash flows provided by (used in) financing activities (555.6) (154.4) 29.6

Exchange rate effect on cash and cash equivalents 9.9 24.7 (37.2)

Net increase (decrease) in cash and cash equivalents (194.6) 327.3 (279.3)

Cash and cash equivalents at beginning of period 905.4 578.1 857.4

Cash and cash equivalents at end of period $ 710.8 $ 905.4 $ 578.1

See accompanying notes to consolidated financial statements.

F-7