GameStop 2010 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Uses of Capital

Our future capital requirements will depend on the number of new stores we open and the timing of those openings within a given fiscal year.

We opened 359 stores in fiscal 2010. We expect to open approximately 300 stores in fiscal 2011. Capital expenditures for fiscal 2011 are projected

to be approximately $170 million, to be used primarily to fund continued digital initiatives, new store openings, store remodels and invest in

distribution and information systems in support of operations.

Between May 2006 and October 2010, the Company repurchased and redeemed the $300 million of Senior Floating Rate Notes and

$400 million of Senior Notes under previously announced buybacks authorized by its Board of Directors. All of the authorized amounts were

repurchased or redeemed and the repurchased Notes were delivered to the Trustee for cancellation. The associated loss on the retirement of debt was

$6.0 million, $5.3 million and $2.3 million for the 52 week periods ended January 29, 2011, January 30, 2010 and January 31, 2009, respectively,

which consisted of the premium paid to retire the Notes and the write-off of the deferred financing fees and the original issue discount on the Notes.

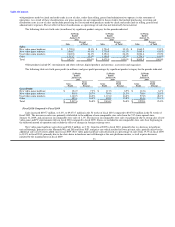

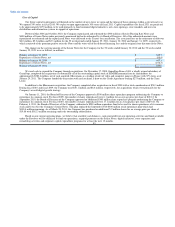

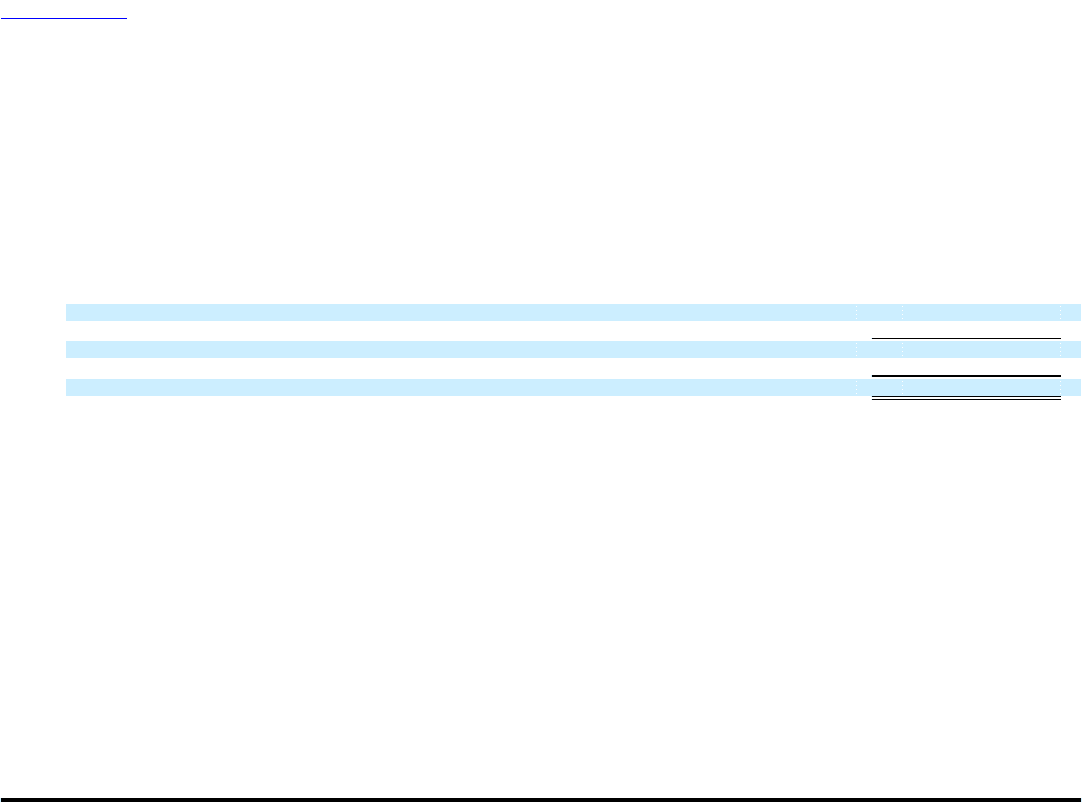

The changes in the carrying amount of the Senior Notes for the Company for the 52 weeks ended January 30, 2010 and the 52 weeks ended

January 29, 2011 were as follows, in millions:

Balance at January 31, 2009 $ 545.7

Repurchase of Senior Notes, net (98.4)

Balance at January 30, 2010 $ 447.3

Repurchase of Senior Notes, net (198.3)

Balance at January 29, 2011 $ 249.0

We used cash to expand the Company through acquisitions. On November 17, 2008, GameStop France SAS, a wholly owned subsidiary of

GameStop, completed the acquisition of substantially all of the outstanding capital stock of SFMI Micromania from its shareholders for

approximately $580.4 million, net of cash acquired. Micromania is a leading retailer of video and computer games in France with 379 stores as of

January 29, 2011. The Company funded the transaction with cash on hand, a draw on the Credit Agreement totaling $275 million, and the Term

Loans.

In addition to the Micromania acquisition, the Company completed other acquisitions in fiscal 2008 with a total consideration of $50.3 million.

During fiscal 2010 and fiscal 2009, the Company used $38.1 million and $8.4 million, respectively, for acquisitions which were primarily for the

Company's overall digital growth strategy.

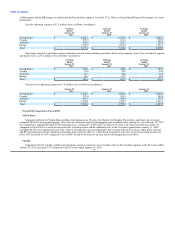

On January 11, 2010, the Board of Directors of the Company approved a $300 million share repurchase program authorizing the Company to

repurchase its common stock. For fiscal 2009, the number of shares repurchased were 6.1 million for an average price per share of $20.12. In

September 2010, the Board of Directors of the Company approved an additional $300 million share repurchase program authorizing the Company to

repurchase its common stock. For fiscal 2010, the number of shares repurchased were 17.1 million for an average price per share of $19.84. On

February 4, 2011, the Board of Directors of the Company authorized a $500 million repurchase fund to be used for share repurchases of its common

stock and/or to retire the Company's Senior Notes. This plan replaced the September 2010 $300 million stock repurchase plan which had

$138.4 million remaining. As of March 24, 2011, the Company has purchased an additional 5.9 million shares for an average price per share of

$19.88 with $382.3 million remaining under the outstanding authorization.

Based on our current operating plans, we believe that available cash balances, cash generated from our operating activities and funds available

under the Revolver will be sufficient to fund our operations, required payments on the Senior Notes, digital initiatives, store expansion and

remodeling activities and corporate capital expenditure programs for at least the next 12 months.

43