GameStop 2010 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

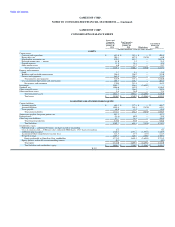

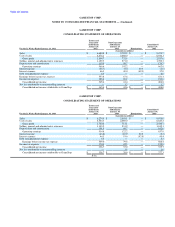

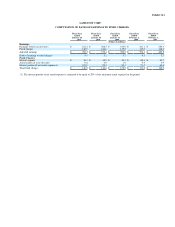

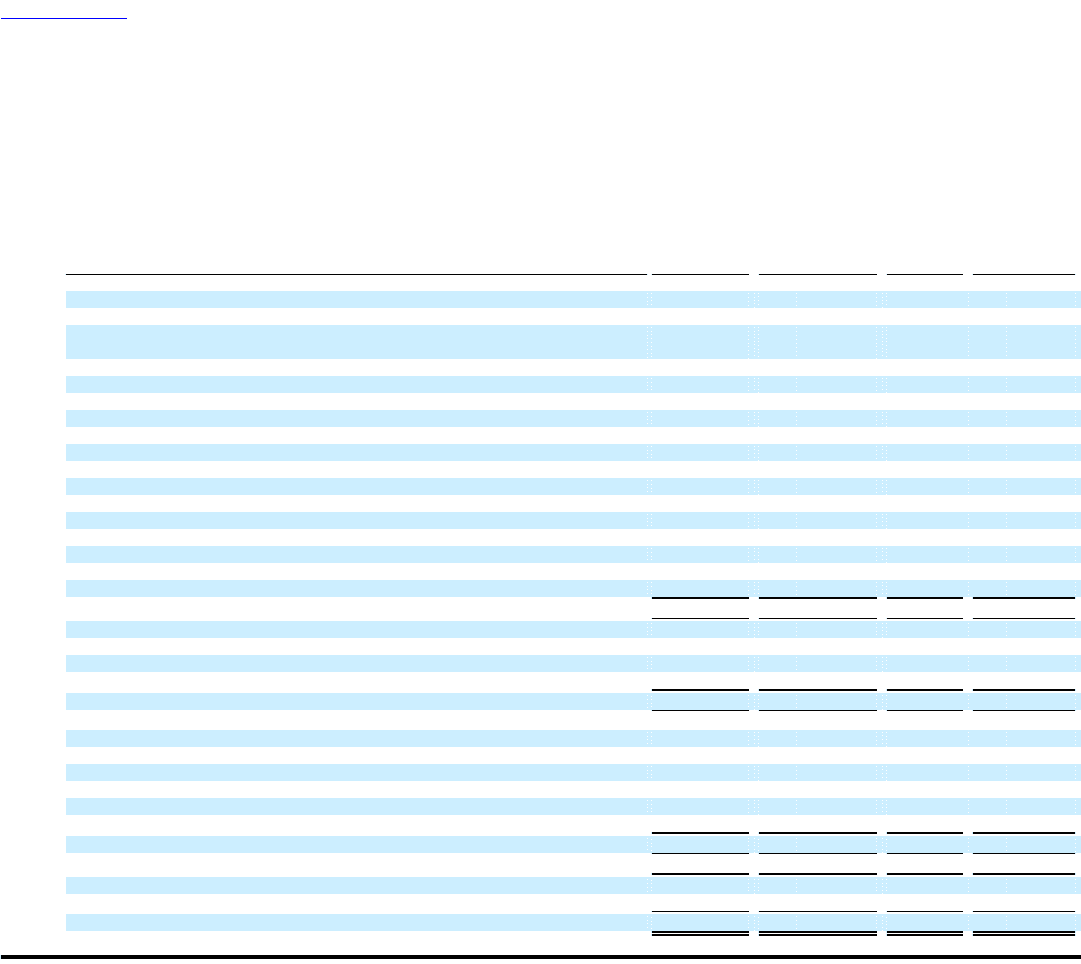

GAMESTOP CORP.

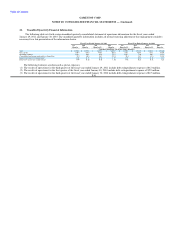

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

GAMESTOP CORP.

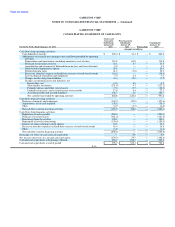

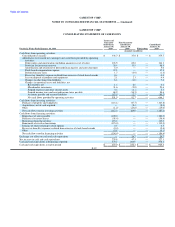

CONSOLIDATING STATEMENT OF CASH FLOWS

Issuers and

Guarantor Non-Guarantor

Subsidiaries Subsidiaries Consolidated

January 31, January 31, January 31,

For the 52 Weeks Ended January 31, 2009 2009 2009 Eliminations 2009

(Amounts in millions)

Cash flows from operating activities:

Consolidated net income $ 335.7 $ 62.6 $ — $ 398.3

Adjustments to reconcile net earnings to net cash flows provided by (used in)

operating activities:

Depreciation and amortization (including amounts in cost of sales) 104.9 41.5 — 146.4

Provision for inventory reserves 34.9 8.1 — 43.0

Amortization and retirement of deferred financing fees and issue discounts 3.7 — — 3.7

Stock-based compensation expense 35.4 — — 35.4

Deferred income taxes (23.3) (1.4) — (24.7)

Excess tax benefits realized from exercise of stock-based awards (34.2) — — (34.2)

Loss on disposal of property and equipment 3.0 2.2 — 5.2

Changes in other long-term liabilities 1.1 6.3 — 7.4

Changes in operating assets and liabilities, net

Receivables, net 3.2 (648.5) 642.4 (2.9)

Merchandise inventories (170.3) (39.2) — (209.5)

Prepaid expenses and other current assets (10.1) (6.3) — (16.4)

Prepaid income taxes and accrued income taxes payable 47.8 (3.9) — 43.9

Accounts payable and accrued liabilities 768.1 27.9 (642.4) 153.6

Net cash flows provided by (used in) operating activities 1,099.9 (550.7) — 549.2

Cash flows from investing activities:

Purchase of property and equipment (117.5) (65.7) — (183.2)

Acquisitions, net of cash acquired — (630.7) — (630.7)

Other (1,310.2) 1,303.2 — (7.0)

Net cash flows provided by (used in) investing activities (1,427.7) 606.8 — (820.9)

Cash flows from financing activities:

Repurchase of notes payable (30.0) — — (30.0)

Borrowings for acquisition 425.0 — — 425.0

Repayments of acquisition borrowings (425.0) — — (425.0)

Issuance of shares relating to stock options 28.9 — — 28.9

Excess tax benefits realized from exercise of stock-based awards 34.2 — — 34.2

Other (3.5) — — (3.5)

Net cash flows provided by financing activities 29.6 — — 29.6

Exchange rate effect on cash and cash equivalents — (37.2) — (37.2)

Net increase (decrease) in cash and cash equivalents (298.2) 18.9 — (279.3)

Cash and cash equivalents at beginning of period 671.4 186.0 — 857.4

Cash and cash equivalents at end of period $ 373.2 $ 204.9 $ — $ 578.1

F-40