GameStop 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

cash flows. The impairment testing process is subject to inherent uncertainties and subjectivity, particularly related to sales and gross margin

which can be impacted by various factors including the items listed in Item 1A. Risk Factors. While the fair value is determined based on the

best available information at the time of assessment, any changes in business or economic conditions could materially increase or decrease the

fair value of the reporting unit's net assets and, accordingly, could materially increase or decrease any related impairment charge. Based on

currently available information and forecasts of the Company's annual results, we do not anticipate recording any impairment of goodwill or

other intangible assets in any of the Company's reporting units for the fiscal year ending January 28, 2012.

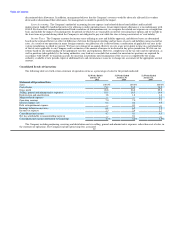

Other Intangible Assets and Other Noncurrent Assets. Other intangible assets consist primarily of tradenames, leasehold rights,

advertising relationships and amounts attributed to favorable leasehold interests recorded primarily as a result of the Micromania acquisition

and the EB merger. We record intangible assets apart from goodwill if they arise from a contractual right and are capable of being separated

from the entity and sold, transferred, licensed, rented or exchanged individually. The useful life and amortization methodology of intangible

assets are amortized over the period in which they are expected to contribute directly to cash flows.

Tradenames which were recorded as a result of acquisitions, primarily Micromania, are considered indefinite life intangible assets as

they are expected to contribute to cash flows indefinitely and are not subject to amortization, but they are subject to annual impairment testing.

Leasehold rights which were recorded as a result of the Micromania acquisition represent the value of rights of tenancy under commercial

property leases for properties located in France. Rights pertaining to individual leases can be sold by us to a new tenant or recovered by us

from the landlord if the exercise of the automatic right of renewal is refused. Leasehold rights are amortized on a straight-line basis over the

expected lease term not to exceed 20 years with no residual value. Favorable leasehold interests represent the value of the contractual monthly

rental payments that are less than the current market rent at stores acquired as part of the Micromania acquisition or the EB merger. Favorable

leasehold interests are amortized on a straight-line basis over their remaining lease term with no expected residual value. For additional

information related to the Company's intangible assets, see Note 8 of "Notes to Consolidated Financial Statements."

Other non-current assets are made up of deposits and deferred financing fees. The deferred financing fees are associated with the

Company's revolving credit facility and the senior notes issued in October 2005 in connection with the financing of the EB merger. The

deferred financing fees are being amortized over five and seven years to match the terms of the revolving credit facility and the senior notes,

respectively.

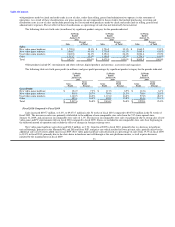

Cash Consideration Received from Vendors. The Company and its vendors participate in cooperative advertising programs and other

vendor marketing programs in which the vendors provide the Company with cash consideration in exchange for marketing and advertising the

vendors' products. Our accounting for cooperative advertising arrangements and other vendor marketing programs results in a portion of the

consideration received from our vendors reducing the product costs in inventory. The consideration serving as a reduction in inventory is

recognized in cost of sales as inventory is sold. The amount of vendor allowances recorded as a reduction of inventory is determined by

calculating the ratio of vendor allowances in excess of specific, incremental and identifiable advertising and promotional costs to merchandise

purchases. The Company then applies this ratio to the value of inventory in determining the amount of vendor reimbursements recorded as a

reduction to inventory reflected on the balance sheet. Because of the variability in the timing of our advertising and marketing programs

throughout the year, the Company uses significant estimates in determining the amount of vendor allowances recorded as a reduction of

inventory in interim periods, including estimates of full year vendor allowances, specific, incremental and identifiable advertising and

promotional costs, merchandise purchases and value of inventory. Estimates of full year vendor allowances and the value of inventory are

dependent upon estimates of full year merchandise purchases. Determining the amount of vendor allowances recorded as a reduction of

inventory at the end of the fiscal year no longer requires the use of estimates as all vendor allowances, specific, incremental and identifiable

advertising and promotional costs, merchandise purchases and value of inventory are known.

Although management considers its advertising and marketing programs to be effective, we do not believe that we would be able to

incur the same level of advertising expenditures if the vendors decreased or

31