GE 2014 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2014 FORM 10-K 71

MD&A STATEMENT OF FINANCIAL POSITION

x GE All other liabilities increased $13.7 billion primarily due to an increase in the postretirement benefit liabilities of

$13.9 billion primarily due to lower discount rate and new mortality assumptions. The impact of these changes was the

primary driver for the decrease in accumulated other comprehensive income (loss) – benefit plans of $7.3 billion.

See Notes 12 and 15 to the consolidated financial statements in this Form 10-K Report.

x Accumulated other comprehensive income (loss) – currency translation adjustments decreased $2.6 billion driven

by the strengthening U.S. dollar against all major currencies at December 31, 2014 compared with December 31, 2013.

This decrease coincides with general decreases in balances of our major asset and liability categories, including:

Financing receivables; Property, plant and equipment; Goodwill; Intangible assets; Short-term borrowings and Long-term

borrowings.

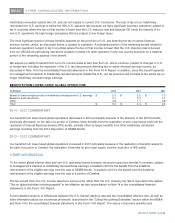

FINANCING RECEIVABLES

Financing receivables is our largest category of assets and represents one of our primary sources of revenues. Our portfolio of

financing receivables is diverse and not directly comparable to major U.S. banks. A discussion of the quality of certain

elements of the financing receivables portfolio follows.

Our commercial portfolio primarily comprises senior secured positions with comparatively low loss history. The secured

receivables in this portfolio are collateralized by a variety of asset classes, which for our CLL business primarily include:

industrial-related facilities and equipment, vehicles, corporate aircraft, and equipment used in many industries, including the

construction, manufacturing, transportation, media, communications, entertainment, and healthcare industries. The portfolios

in our Real Estate, GECAS and Energy Financial Services businesses are collateralized by commercial real estate,

commercial aircraft and operating assets in the global energy and water industries, respectively. We are in a secured position

for substantially all of our commercial portfolio.

Our consumer portfolio is composed primarily of non-U.S. mortgage, sales finance, auto and personal loans in various

European and Asian countries and U.S. consumer credit card and sales finance receivables.

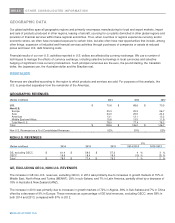

During the first quarter of 2014, we combined our CLL Europe and CLL Asia portfolios into CLL International and we

transferred our CLL Other portfolio to the CLL Americas portfolio. During the fourth quarter of 2014, we combined our

Consumer Non-U.S. auto portfolio into our Consumer Non-U.S. installment and revolving credit portfolio. Prior-period amounts

were reclassified to conform to the current-period presentation.

Our risk management process includes standards and policies for reviewing major risk exposures and concentrations, and

evaluates relevant data either for individual loans or financing leases, or on a portfolio basis, as appropriate.

Loans acquired in a business acquisition are recorded at fair value, which incorporates our estimate at the acquisition date of

the credit losses over the remaining life of the portfolio. As a result, the allowance for losses is not carried over at acquisition.

This may have the effect of causing lower reserve coverage ratios for those portfolios.

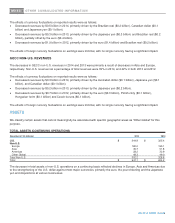

For purposes of the discussion that follows, “delinquent” receivables are those that are 30 days or more past due based on

their contractual terms. Loans purchased at a discount are initially recorded at fair value and accrete interest income over the

estimated life of the loan based on reasonably estimable cash flows even if the underlying loans are contractually delinquent at

acquisition. “Nonaccrual” financing receivables are those on which we have stopped accruing interest. We stop accruing

interest at the earlier of the time at which collection of an account becomes doubtful or the account becomes 90 days past

due, with the exception of consumer credit card accounts, for which we continue to accrue interest until the accounts are

written off in the period that the account becomes 180 days past due. Recently restructured financing receivables are not

considered delinquent when payments are brought current according to the restructured terms, but may remain classified as

nonaccrual until there has been a period of satisfactory payment performance by the borrower and future payments are

reasonably assured of collection.