GE 2014 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

68 GE 2014 FORM 10-K

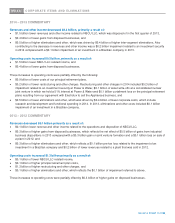

MD&A OTHER CONSOLIDATED INFORMATION

GEOGRAPHIC DATA

Our global activities span all geographic regions and primarily encompass manufacturing for local and export markets, import

and sale of products produced in other regions, leasing of aircraft, sourcing for our plants domiciled in other global regions and

provision of financial services within these regional economies. Thus, when countries or regions experience currency and/or

economic stress, we often have increased exposure to certain risks, but also often have new opportunities that include, among

other things, expansion of industrial and financial services activities through purchases of companies or assets at reduced

prices and lower U.S. debt financing costs.

Financial results of our non-U.S. activities reported in U.S. dollars are affected by currency exchange. We use a number of

techniques to manage the effects of currency exchange, including selective borrowings in local currencies and selective

hedging of significant cross-currency transactions. Such principal currencies are the euro, the pound sterling, the Canadian

dollar, the Japanese yen, the Australian dollar and the Brazilian real.

REVENUES

Revenues are classified according to the region to which products and services are sold. For purposes of this analysis, the

U.S. is presented separately from the remainder of the Americas.

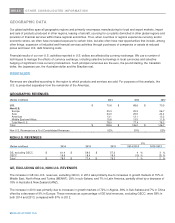

GEOGRAPHIC REVENUES

(Dollars in billions) 2014 2013 2012

U.S. $ 70.6 $ 68.6 $ 70.5

Non-U.S.

Euro

p

e 25.3 25.3 26.7

Asia 24.0 25.5 24.4

Americas 13.1 13.1 13.2

Middle East and Africa 15.6 13.5 11.9

Total Non-U.S. 78.0 77.4 76.2

Total $ 148.6 $ 146.0 $ 146.7

Non-U.S. Revenues as a % of Consolidated Revenues 52% 53% 52%

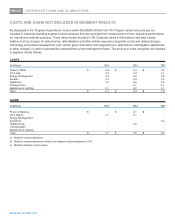

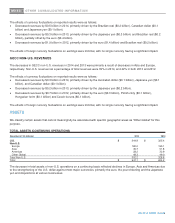

NON-U.S. REVENUES

V%

(Dollars in billions) 2014 2013 2012 2014-2013 2013-2012

GE, excludin

g

GECC $ 61.4 $ 59.0 $ 57.3 4 % 3 %

GECC 16.6 18.4 19.0

(

10

)

%

(

3

)

%

Total $ 78.0 $ 77.4 $ 76.2 1 % 2 %

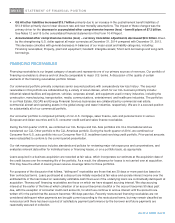

GE, EXCLUDING GECC, NON-U.S. REVENUES

The increase in GE non-U.S. revenues, excluding GECC, in 2014 was primarily due to increases in growth markets of 15% in

Middle East, North Africa and Turkey (MENAT), 29% in sub-Sahara, and 7% in Latin America, partially offset by a decrease of

18% in Australia & New Zealand (ANZ).

The increase in 2013 was primarily due to increases in growth markets of 72% in Algeria, 38% in Sub-Sahara and 7% in China

offset by a decrease of 9% in Europe. These revenues as a percentage of GE total revenues, excluding GECC, were 58% in

both 2014 and 2013, compared with 57% in 2012.