GE 2014 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2014 FORM 10-K 209

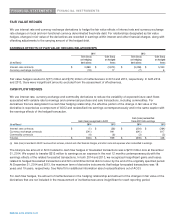

FINANCIAL STATEMENTS COMMITMENTS, PRODUCT WARRANTIES AND GUARANTEES

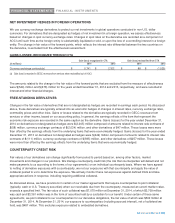

INVESTMENTS IN UNCONSOLIDATED VARIABLE INTEREST ENTITIES

Our involvement with unconsolidated VIEs consists of the following activities: assisting in the formation and financing of the

entity; providing recourse and/or liquidity support; servicing the assets; and receiving variable fees for services provided. We

are not required to consolidate these entities because the nature of our involvement with the activities of the VIEs does not

give us power over decisions that significantly affect their economic performance.

Our largest exposure to any single unconsolidated VIE at December 31, 2014 is a $8,612 million investment in asset-backed

securities issued by the Senior Secured Loan Program (“SSLP”), a fund that invests in high-quality senior secured debt of

various middle-market companies. Other significant unconsolidated VIEs include investments in real estate entities ($1,564

million), which generally consist of passive limited partnership investments in tax-advantaged, multi-family real estate and

investments in various European real estate entities; and exposures to joint ventures that purchase factored receivables

($2,166 million).

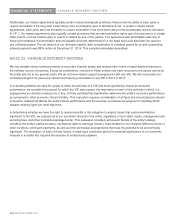

The classification of our variable interests in these entities in our financial statements is based on the nature of the entity and

the type of investment we hold. Variable interests in partnerships and corporate entities are classified as either equity method

or cost method investments. In the ordinary course of business, we also make investments in entities in which we are not the

primary beneficiary but may hold a variable interest such as limited partner interests or mezzanine debt investments. These

investments are classified in two captions in our financial statements: “All other assets” for investments accounted for under

the equity method, and “Financing receivables – net” for debt financing provided to these entities.

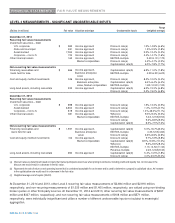

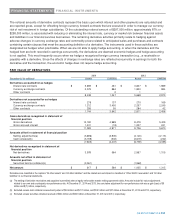

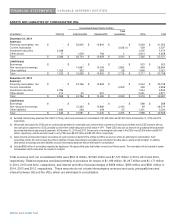

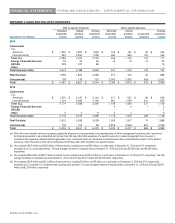

INVESTMENTS IN UNCONSOLIDATED VIEs

December 31 (In millions) 2014 2013

Other assets and investment securities $ 9,500 $ 9,129

Financing receivables – net 2,942 3,346

Total investments 12,442 12,475

Contractual obligations to fund investments or guarantees 2,218 2,741

Revolving lines of credit 168 31

Total $ 14,828 $ 15,247

In addition to the entities included in the table above, we also hold passive investments in RMBS, CMBS and ABS issued by

VIEs. Such investments were, by design, investment-grade at issuance and held by a diverse group of investors. Further

information about such investments is provided in Note 3.

NOTE 24. COMMITMENTS, PRODUCT WARRANTIES AND GUARANTEES

COMMITMENTS

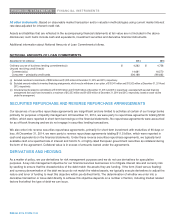

In our Aviation segment, we had committed to provide financing assistance on $2,887 million of future customer acquisitions of

aircraft equipped with our engines, including commitments made to airlines in 2014 for future sales under our GE90 and GEnx

engine campaigns. The GECAS business of GE Capital had placed multiple-year orders for various Boeing, Airbus and other

aircraft with list prices approximating $25,232 million and secondary orders with airlines for used aircraft of approximately

$2,144 million at December 31, 2014.