GE 2014 Annual Report Download - page 218

Download and view the complete annual report

Please find page 218 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

198 GE 2014 FORM 10-K

FINANCIAL STATEMENTS FAIR VALUE MEASUREMENTS

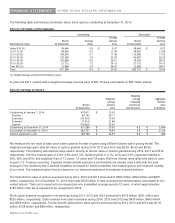

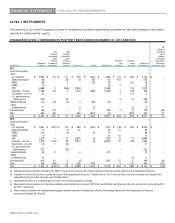

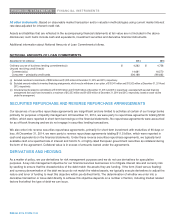

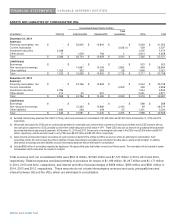

LEVEL 3 INSTRUMENTS

The majority of our Level 3 balances consist of investment securities classified as available-for-sale with changes in fair value

recorded in shareowners’ equity.

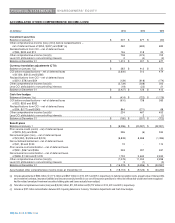

CHANGES IN LEVEL 3 INSTRUMENTS FOR THE YEARS ENDED DECEMBER 31, 2014 AND 2013

Balance at

January 1

Net

realized/

unrealized

gains

(losses)

Included in

earnings(a)

Net

realized

/

unrealized

gains

(losses)

included

in AOCI

Purchases

Sales

Settlements

Transfers

into

Level 3(b)

Transfers

out o

f

Level 3(b)

Balance at

December 31

Net

change in

unrealized

gains

(losses)

relating to

instruments

still held at

December 31(c)

(In millions)

2014

Investment securities

Debt

U.S. corporate $ 2,953 $ 22 $ 121 $ 550 $

(

234

)

$

(

284

)

$ 175 $

(

163

)

$ 3,140 $ -

State and municipal 96 - 38 18

(

36

)

(

10

)

472 - 578 -

RMBS 86 - 2 -

(

16

)

(

9

)

-

(

47

)

16 -

CMBS 10 - - - -

(

3

)

2 - 9 -

ABS 6,898 3

(

206

)

2,249 -

(

1,359

)

-

(

10

)

7,575 -

Corporate – non-U.S. 1,064 30 3 1,019

(

269

)

(

1,033

)

1

(

19

)

796 -

Government – non-U.S. 31 - - - - - 2

(

31

)

2 -

U.S. government and

federal agency 225 - 34 - - - 9

(

2

)

266 -

Retained interests 72 29

(

4

)

3

(

66

)

(

10

)

- - 24 -

Equity

Available-for-sale 11 - - 2

(

2

)

- -

(

2

)

9 -

Derivatives(d)(e) 164 60 1 5 -

(

93

)

2

(

1

)

138

(

26

)

Other 494 86 - 646

(

617

)

(

6

)

-

(

279

)

324 73

Total $ 12

,

104 $ 230 $

(

11

)

$ 4

,

492 $

(

1

,

240

)

$

(

2

,

807

)

$ 663 $

(

554

)

$ 12

,

877 $ 47

2013

Investment securities

Debt

U.S. corporate $ 3,591 $

(

497

)

$ 135 $ 380 $

(

424

)

$

(

231

)

$ 108 $

(

109

)

$ 2,953 $ -

State and municipal 77 -

(

7

)

21 -

(

5

)

10 - 96 -

RMBS 100 -

(

5

)

-

(

2

)

(

7

)

- - 86 -

CMBS 6 - - - -

(

6

)

10 - 10 -

ABS 5,023 5 32 2,632

(

4

)

(

795

)

12

(

7

)

6,898 -

Corporate – non-U.S. 1,218

(

103

)

49 5,814

(

3

)

(

5,874

)

21

(

58

)

1,064 -

Government – non-U.S. 42 1

(

12

)

- - - - - 31 -

U.S. government and

federal agency 277 -

(

52

)

- - - - - 225 -

Retained interests 83 3 1 6 -

(

21

)

- - 72 -

Equity

Available-for-sale 13 - - - - - -

(

2

)

11 -

Derivatives(d)(e) 416 43 2

(

2

)

-

(

335

)

37 3 164

(

30

)

Other 799

(

68

)

12 538

(

779

)

- 4

(

12

)

494

(

102

)

Total $ 11

,

645 $

(

616

)

$ 155 $ 9

,

389 $

(

1

,

212

)

$

(

7

,

274

)

$ 202 $

(

185

)

$ 12

,

104 $

(

132

)

(a) Earnings effects are primarily included in the “GECC revenues from services” and “Interest and other financial charges” captions in the Statement of Earnings.

(b) Transfers in and out of Level 3 are considered to occur at the beginning of the period. Transfers out of Level 3 were primarily a result of increased use of quotes from

independent pricing vendors based on recent trading activity.

(c) Represents the amount of unrealized gains or losses for the period included in earnings.

(d) Represents derivative assets net of derivative liabilities and included cash accruals of $12 million and $9 million not reflected in the fair value hierarchy table during 2014

and 2013, respectively.

(e) Gains (losses) included in net realized/unrealized gains (losses) included in earnings were offset by the earnings effects from the underlying items that were

economically hedged. See Note 22.