GE 2014 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

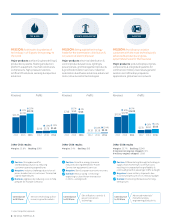

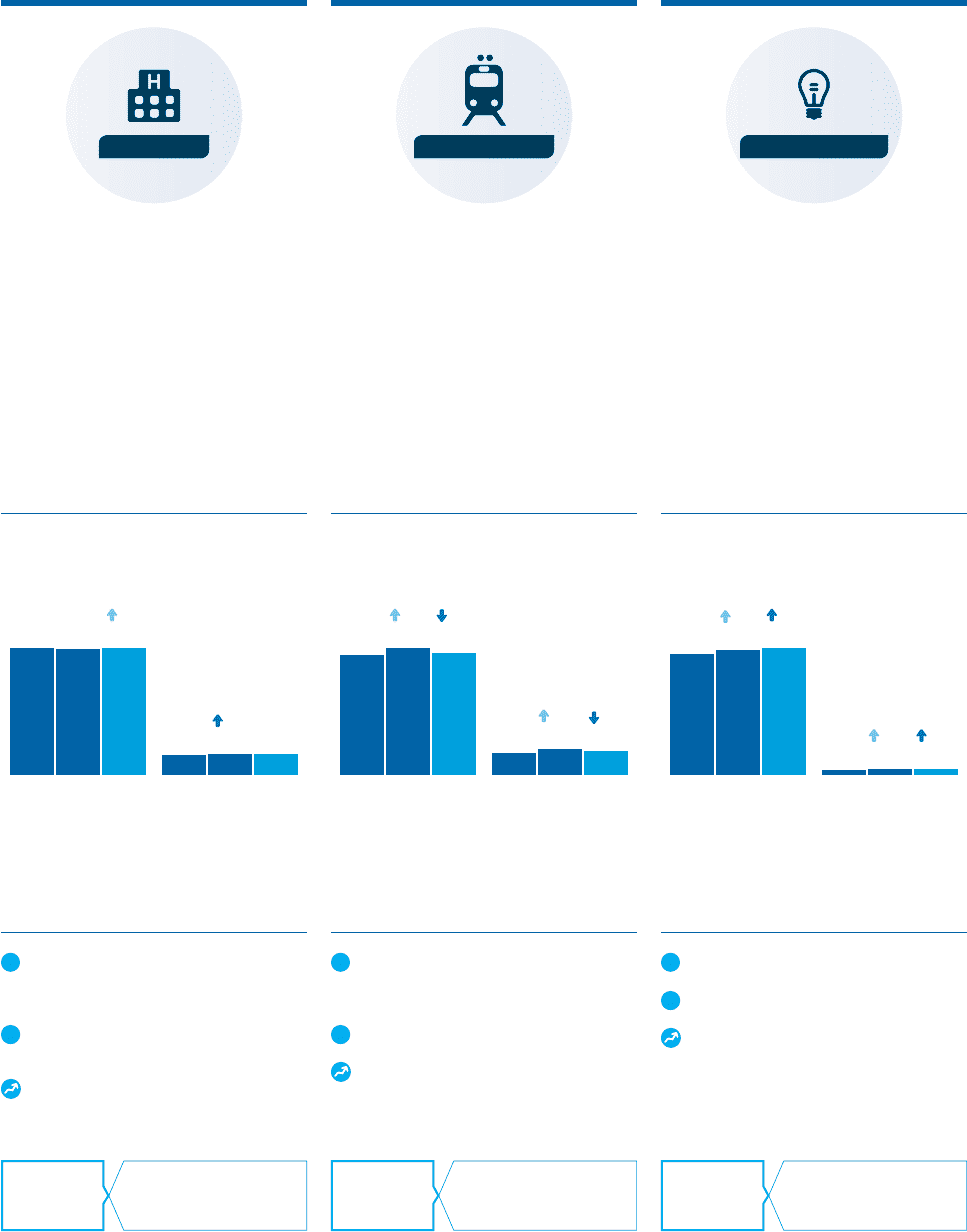

HEALTHCARE TRANSPORTATION APPLIANCES & LIGHTING

MISSION: Developing transformational

medical technologies & services that are

shaping a new age of patient care

Major products: diagnostic imaging

systems (MRI, CT, nuclear & molecular

imaging, digital mammography), surgical

imaging products, ultrasound, protein &

cellular analysis tools, software & analytics

solutions to optimize healthcare delivery

MISSION: Being a global technology

leader & supplier to the railroad, mining,

marine, stationary power, drilling & energy

storage industries

Major products: locomotives, diesel

engines, drilling motors, mining equipment

& propulsion systems, motorized drive

systems, signaling systems, software &

analytics solutions to optimize rail

transportation

MISSION: Answering real-life needs,

defi ning trends & simplifying routines.

Leading a global lighting revolution to deliver

innovative solutions that change the way

people light & think about their world

Major products: lighting products &

services, such as industrial-scale lighting

solutions & major home appliances, such

as refrigerators, cooktops, dishwashers &

hybrid water heaters

Revenues Profi ts Revenues Profi ts Revenues Profi ts

$18.3B –

$18.2B

1%

$18.3B

$2.9B

4%

$3.0B –

$3.0B

2012 2013 2014 2012 2013 2014

$5.6B

5%

$5.9B 4%

$5.7B

$1.0B

13%

$1.2B 3%

$1.1B

2012 2013 2014 2012 2013 2014

$8.0B

5%

$8.3B

1%

$8.4B

$0.3B

23%

$0.4B 13%

$0.4B

2012 2013 2014 2012 2013 2014

Other 2014 results

Margins: 16.7% Backlog: $16B

U.S. orders: $8.5B Europe orders: $3.7B

Growth region orders: $5.7B

Other 2014 results

Margins: 20.0% Backlog: $21B

# locomotives shipped: 796

Other 2014 results

Margins: 5.1%

+ Positive: World-class data & analytics

capability, continued growth in most emerging

markets, hospital demand for services & IT

solutions & signs of improvement in U.S. market

– Negative: Slow growth in other developed

markets due to pressure on healthcare spend

& effects of a stronger U.S. dollar

Outlook: Growing through product leadership,

solution offerings & disciplined operations

+ Positive: Fewer parked locomotives & network

velocity, increased commodity volume &

U.S. growth driven by early demand for Tier 4

locomotives

– Negative: Continued softness in global

commodity prices pressuring mining

Outlook: Growing earnings through

technology leadership

+ Positive: U.S. housing up but normalizing &

strong global shift to energy-effi cient lighting

– Negative: Slowing demand in professional

non-LED market segment

Outlook: Expecting to close sale of Appliances

to Electrolux by mid-20151 & repositioning

Lighting

1. Subject to regulatory approvals.

Diagnostics technology,

software & fi rst-mover in

growth markets

Engine technology & growth

market localization

LED is gateway to energy

effi ciency

Contribution

to GE Store Contribution

to GE Store Contribution

to GE Store

GE 2014 FORM 10-K 9