GE 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our industrial performance was broad-

based with 5/7 segments growing. Industrial

organic revenue growth was 7%, sub-

stantially above our peers. We ended the

year with $261 billion of backlog, a record.

Margins expanded to 16.2%. We contin-

ued to see the benefi ts from simplifi cation

and our productivity programs. CFOA

was $15.2 billion, and free cash fl ow was

$11.2 billion, up 6%. We had solid perfor-

mance on cash, but there is room for upside

in the future.

Our goal is to hit 17% margins and returns

by 2016. Over the last few years, we

have made substantial progress on our

structural cost, reducing it by $4 billion

to a world-class level. The next wave of

improvement will be targeting product

cost, segment gross margins and returns.

GE has approximately a $100 billion cost

base, 70% of which are direct product

and service costs. Our “segment gross

margins,” the revenue in excess of these

costs, are 27%.

with a cycle of days and weeks. Because

of our industrial context, we can rapidly

co-create applications with customers. We

think of our Software COE as an Industrial

Internet “App Factory” producing outcomes

ranging from asset synchronization to

reducing unplanned downtime.

The Industrial Internet will transform GE.

Wind is one of our newest businesses.

“PowerUp” is a Predictivity app that

increases wind farm output by 5% and

profi tability by 20% through controls and

analytics. Lighting is our oldest business.

The combination of LEDs and analytics puts

a computer where a light bulb used to be.

In cities around the world, GE is working to

transform street lighting into the analytical

brain of urban life. Today, Lighting is becom-

ing a high-tech infrastructure business.

It is a gateway for most energy manage-

ment solutions.

GE will create investor value through our

leadership in the Industrial Internet. Our

deep knowledge of machines is a profound

advantage, and our domain expertise is

necessary to make analytics meaningful.

Because of our existing service relation-

ships with customers, we have a gateway

to create valuable outcomes for them and

profi table growth for GE.

Value Creating Execution

Last year, we asked you to look at our

earnings over a three-year period, from

2014–16. Over that time, we would improve

our earnings mix to more than 75% indus-

trial, return $50 billion to investors

in dividends and share repurchase, while

growing returns and EPS each year.

In 2014, we executed the fi rst phase of that

journey. We grew operating EPS 1% to $1.65.

Our industrial segment profi ts were up 10%,

while fi nancial profi ts declined 12%. GE’s

industrial earnings are about 60% of our total.

GE Capital ENI declined 5% to $363 billion.

GE Capital ended the year with a Tier 1 capi-

tal ratio of 12.7% and $76 billion of liquidity.

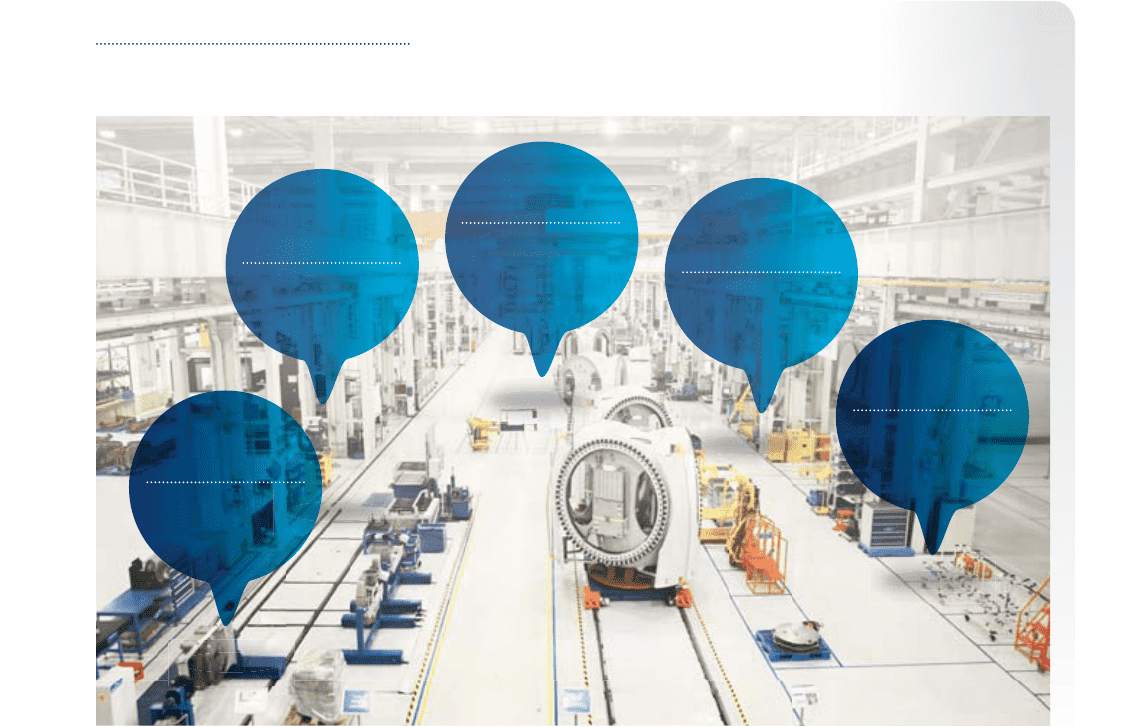

THE BRILLIANT FACTORY

At factories like GE’s new multimodal manufacturing facility in Pune, India (pictured below), we are harnessing the power of analytics

to make our products—everything from wind turbines to locomotives in this facility—more effi ciently and at lower cost.

LETTER TO SHAREOWNERS

INTELLIGENT

MACHINES

Brilliant machines with

remote programming

capabilities

VIRTUAL DESIGN

AND ENGINEERING

Rapid design and

prototyping in-house

MATERIAL SCIENCE

Transformative materials

used across multiple

GE businesses

ADDITIVE

MANUFACTURING

Metallic and

non-metallic

3-D printing

SUPERCOMPUTING

Real-time

computational modeling

and simulation

GE 2014 ANNUAL REPORT 11