GE 2014 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

GE 2014 FORM 10-K 169

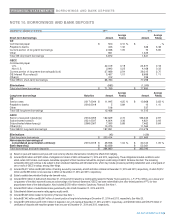

FINANCIAL STATEMENTS BORROWINGS AND BANK DEPOSITS

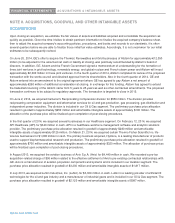

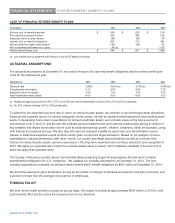

NOTE 10. BORROWINGS AND BANK DEPOSITS

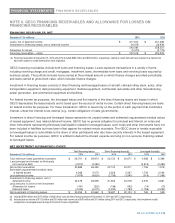

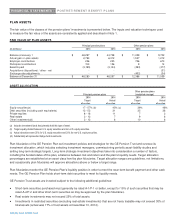

December 31

(

Dollars in millions

)

2014 2013

Short-term borrowings Amount Average

Rate(a) Amount Average

Rate(a)

GE

Commercial paper $ 500 0.10 % $ - - %

Payable to banks 343 1.32 346 3.38

Current portion of long-term borrowings 2,068 1.05 70 5.65

Other 961 1,425

Total GE short-term borrowings 3,872 1,841

GECC

Commercial paper

U.S. 22,019 0.19 24,877 0.18

Non-U.S. 2,993 0.25 4,168 0.33

Current portion of lon

g

-term borrowin

g

s(b)(c)(f) 37,989 2.54 39,215 2.70

GE Interest Plus notes(d) 5,467 1.01 8,699 1.11

Other(c) 312 339

Total GECC short-term borrowin

g

s 68,780 77,298

Eliminations (863) (1,249)

Total short-term borrowin

g

s $ 71,789 $ 77,890

Long-term borrowings Maturities Amount Average

Rate(a) Amount Average

Rate(a)

GE

Senior notes 2017-2044 $ 11,945 4.25 % $ 10,968 3.63 %

Payable to banks 2016-2019 5 0.89 10 1.10

Other 518 537

Total GE long-term borrowings 12,468 11,515

GECC

Senior unsecured notes(b)(e) 2016-2055 162,629 2.72 186,433 2.97

Subordinated notes(f) 2021-2037 4,804 3.36 4,821 3.93

Subordinated debentures(

g

) 2066-2067 7,085 5.88 7,462 5.64

Other(c)(h) 13,473 11,563

Total GECC lon

g

-term borrowin

g

s 187,991 210,279

Eliminations (45) (129)

Total lon

g

-term borrowin

g

s $ 200,414 $ 221,665

Non-recourse borrowin

g

s of

consolidated securitization entities(i) 2015-2019 $ 29,938 1.04 % $ 30,124 1.05 %

Bank deposits(j) $ 62,839 $ 53,361

Total borrowin

g

s and bank de

p

osits

$

364

,

980

$

383

,

040

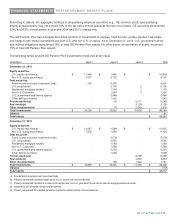

(a) Based on year-end balances and year-end local currency effective interest rates, including the effects from hedging.

(b) Included $439 million and $481 million of obligations to holders of GICs at December 31, 2014 and 2013, respectively. These obligations included conditions under

which certain GIC holders could require immediate repayment of their investment should the long-term credit ratings of GECC fall below AA-/Aa3. The remaining

outstanding GICs will continue to be subject to their scheduled maturities and individual terms, which may include provisions permitting redemption upon a downgrade of

one or more of GECC’s ratings, among other things.

(c) Included $6,017 million and $9,468 million of funding secured by real estate, aircraft and other collateral at December 31, 2014 and 2013, respectively, of which $2,312

million and $2,868 million is non-recourse to GECC at December 31, 2014 and 2013, respectively.

(d) Entirely variable denomination floating-rate demand notes.

(e) Included $700 million of debt at both December 31, 2014 and 2013 raised by a funding entity related to Penske Truck Leasing Co., L.P. (PTL). GECC, as co-issuer and

co-guarantor of the debt, reports this amount as borrowings in its financial statements. GECC has been indemnified by the other limited partners of PTL for their

proportionate share of the debt obligation. Also included $3,593 million related to Synchrony Financial. See Note 1.

(f) Included $300 million of subordinated notes guaranteed by GE at both December 31, 2014 and 2013.

(g) Subordinated debentures receive rating agency equity credit.

(h) Included $8,245 million related to Synchrony Financial. See Note 1.

(i) Included $7,442 million and $9,047 million of current portion of long-term borrowings at December 31, 2014 and 2013, respectively. See Note 23.

(j) Included $10,258 million and $13,614 million of deposits in non-U.S. banks at December 31, 2014 and 2013, respectively, and $22,848 million and $18,275 million of

certificates of deposits with maturities greater than one year at December 31, 2014 and 2013, respectively.