GE 2014 Annual Report Download - page 205

Download and view the complete annual report

Please find page 205 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256

|

|

GE 2014 FORM 10-K 185

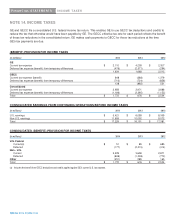

FINANCIAL STATEMENTS INCOME TAXES

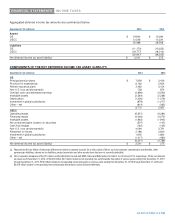

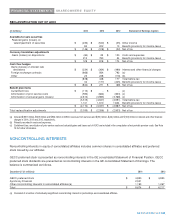

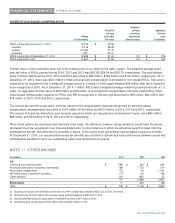

Aggregated deferred income tax amounts are summarized below.

December 31 (In millions) 2014 2013

Assets

GE $ 19,942 $ 15,284

GECC 12,546 13,224

32,488 28,508

Liabilities

GE (11,170) (10,223)

GECC (18,777) (18,010)

(29,947) (28,233)

Net deferred income tax asset (liability) $ 2,541 $ 275

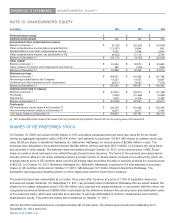

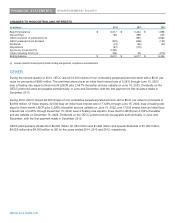

COMPONENTS OF THE NET DEFERRED INCOME TAX ASSET (LIABILITY)

December 31 (In millions) 2014 2013

GE

Principal pension plans $ 7,859 $ 3,436

Provision for expenses(a) 6,192 5,934

Retiree insurance plans 3,462 3,154

Non-U.S. loss carryforwards(b) 738 874

Contract costs and estimated earnings (3,996) (3,550)

Intangible assets (2,364) (2,268)

Depreciation (1,226) (1,079)

Investment in global subsidiaries (979) (1,077)

Other – net (914) (363)

8,772 5,061

GECC

Operating leases (6,351) (6,284)

Financing leases (4,046) (4,075)

Intangible assets (1,963) (1,943)

Net unrealized gains (losses) on securities (507) (145)

Cash flow hedges (162) (163)

Non-U.S. loss carryforwards(b) 4,094 3,791

Allowance for losses 2,186 2,640

Investment in global subsidiaries 1,935 1,883

Other – net (1,417) (490)

(6,231) (4,786)

Net deferred income tax asset (liability) $ 2,541 $ 275

(a) Represented the tax effects of temporary differences related to expense accruals for a wide variety of items, such as employee compensation and benefits, other

pension plan liabilities, interest on tax liabilities, product warranties and other sundry items that are not currently deductible.

(b) Net of valuation allowances of $2,015 million and $2,089 million for GE and $880 million and $862 million for GECC, for 2014 and 2013, respectively. Of the net deferred

tax asset as of December 31, 2014, of $4,832 million, $47 million relates to net operating loss carryforwards that expire in various years ending from December 31, 2015

through December 31, 2017; $166 million relates to net operating losses that expire in various years ending from December 31, 2018 through December 31, 2034 and

$4,619 million relates to net operating loss carryforwards that may be carried forward indefinitely.