GE 2014 Annual Report Download - page 222

Download and view the complete annual report

Please find page 222 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

202 GE 2014 FORM 10-K

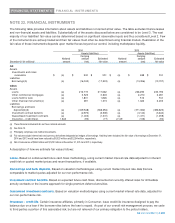

FINANCIAL STATEMENTS FINANCIAL INSTRUMENTS

All other instruments. Based on observable market transaction and/or valuation methodologies using current market interest

rate data adjusted for inherent credit risk.

Assets and liabilities that are reflected in the accompanying financial statements at fair value are not included in the above

disclosures; such items include cash and equivalents, investment securities and derivative financial instruments.

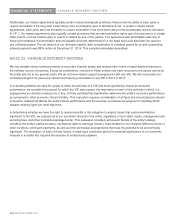

Additional information about Notional Amounts of Loan Commitments follows.

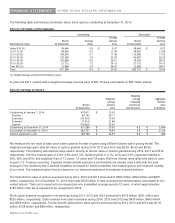

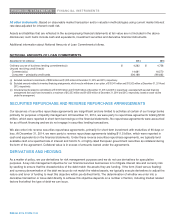

NOTIONAL AMOUNTS OF LOAN COMMITMENTS

December 31 (In millions)

2014 2013

Ordinary course of business lending commitments(a) $ 4,282 $ 4,756

Unused revolving credit lines(b)

Commercial(c) 14,681 16,570

Consumer – principally credit cards 306,188 290,662

(a) Excluded investment commitments of $980 million and $1,395 million at December 31, 2014 and 2013, respectively.

(b) Excluded amounts related to inventory financing arrangements, which may be withdrawn at our option, of $15,041 million and $13,502 million at December 31, 2014 and

2013, respectively.

(c) Included amounts related to commitments of $10,509 million and $11,629 million at December 31, 2014 and 2013, respectively, associated with secured financing

arrangements that could have increased to a maximum of $12,353 million and $14,590 million at December 31, 2014 and 2013, respectively, based on asset volume

under the arrangement.

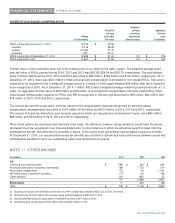

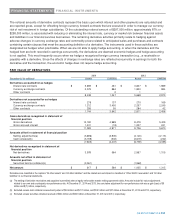

SECURITIES REPURCHASE AND REVERSE REPURCHASE ARRANGEMENTS

Our issuances of securities repurchase agreements are insignificant and are limited to activities at certain of our foreign banks

primarily for purposes of liquidity management. At December 31, 2014, we were party to repurchase agreements totaling $169

million, which were reported in short-term borrowings on the financial statements. No repurchase agreements were accounted

for as off-book financing and we do not engage in securities lending transactions.

We also enter into reverse securities repurchase agreements, primarily for short-term investment with maturities of 90 days or

less. At December 31, 2014, we were party to reverse repurchase agreements totaling $11.5 billion, which were reported in

cash and equivalents on the financial statements. Under these reverse securities repurchase agreements, we typically lend

available cash at a specified rate of interest and hold U.S. or highly-rated European government securities as collateral during

the term of the agreement. Collateral value is in excess of amounts loaned under the agreements.

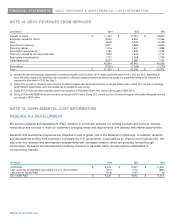

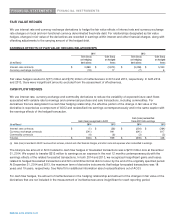

DERIVATIVES AND HEDGING

As a matter of policy, we use derivatives for risk management purposes and we do not use derivatives for speculative

purposes. A key risk management objective for our financial services businesses is to mitigate interest rate and currency risk

by seeking to ensure that the characteristics of the debt match the assets they are funding. If the form (fixed versus floating)

and currency denomination of the debt we issue do not match the related assets, we typically execute derivatives to adjust the

nature and tenor of funding to meet this objective within pre-defined limits. The determination of whether we enter into a

derivative transaction or issue debt directly to achieve this objective depends on a number of factors, including market related

factors that affect the type of debt we can issue.