GE 2014 Annual Report Download - page 188

Download and view the complete annual report

Please find page 188 of the 2014 GE annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

168 GE 2014 FORM 10-K

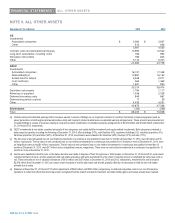

FINANCIAL STATEMENTS ALL OTHER ASSETS

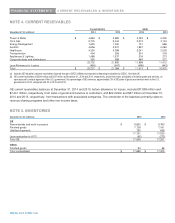

NOTE 9. ALL OTHER ASSETS

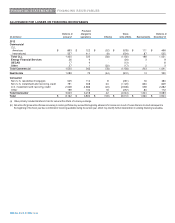

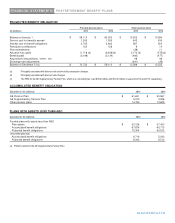

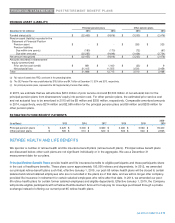

December 31 (in millions) 2014 2013

GE

Investments

Associated companies $ 3,384 $ 3,937

Other 613 626

3,997 4,563

Contract costs and estimated earnings(a) 13,990 12,522

Long-term receivables, including notes 766 993

Derivative instruments 783 623

Other 5,144 5,007

24,680 23,708

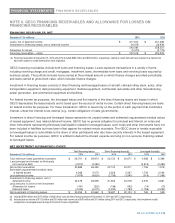

GECC

Investments

Associated companies 16,747 17,348

Real estate(b)(c) 10,891 16,163

Assets held for sale(d) 5,549 2,571

Cost method(c) 566 1,462

Other 1,621 930

35,374 38,474

Derivative instruments 1,794 1,117

Advances to suppliers 1,406 2,328

Deferred borrowing costs 849 867

Deferred acquisition costs(e) 17 29

Other 4,435 4,551

43,875 47,366

Eliminations (330) (266)

Total $ 68,225 $ 70,808

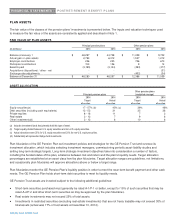

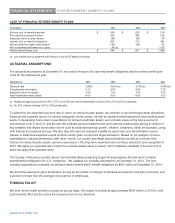

(a) Contract costs and estimated earnings reflect revenues earned in excess of billings on our long-term contracts to construct technically complex equipment (such as

power generation, aircraft engines and aeroderivative units) and long-term product maintenance or extended warranty arrangements. These amounts are presented net

of related billings in excess of revenues relating to long-term product maintenance or extended warranty arrangements of $2,329 million and $1,842 million at December

31, 2014 and 2013, respectively.

(b) GECC investments in real estate consisted principally of two categories: real estate held for investment and equity method investments. Both categories contained a

wide range of properties including the following at December 31, 2014: office buildings (57%), retail facilities (9%), apartment buildings (5%), industrial properties (3%),

franchise properties (3%) and other (23%). At December 31, 2014, investments were located in the Americas (46%), Europe (37%) and Asia (17%).

(c) The fair value of and unrealized loss on cost method investments in a continuous loss position for less than 12 months at December 31, 2014, were $5 million and $1

million, respectively. The fair value of and unrealized loss on cost method investments in a continuous loss position for 12 months or more at December 31, 2014, were

an insignificant amount and $1 million, respectively. The fair value of and unrealized loss on cost method investments in a continuous loss position for less than 12

months at December 31, 2013, were $17 million and an insignificant amount, respectively. There were no cost method investments in a continuous loss position for 12

months or more at December 31, 2013.

(d) Assets were classified as held for sale on the date a decision was made to dispose of them through sale or other means. At December 31, 2014 and 2013, such assets

consisted primarily of loans, aircraft, equipment and real estate properties, and were accounted for at the lower of carrying amount or estimated fair value less costs to

sell. These amounts are net of valuation allowances of $142 million and $127 million at December 31, 2014 and 2013, respectively. Assets held for sale increased

$2,978 million from December 31, 2013 as a result of net increases in held for sale loans and aircraft, partially offset by net decreases in held for sale real estate,

primarily due to sales.

(e) Balances at December 31, 2014 and 2013 reflect adjustments of $624 million and $700 million, respectively, to deferred acquisition costs in our run-off insurance

operations to reflect the effects that would have been recognized had the related unrealized investment securities holding gains and losses actually been realized.